GSV’s weekly insights on the global growth economy. Join 22,000+ readers getting a window to the future by subscribing here:

“Whether you think you can, or you think you can’t, you are right.” – Henry Ford

“Where there is no vision, the people perish.” – Proverbs 29:18

“Every great business I’ve been involved with has nearly died at least 3 times. The fact you are on the ropes I see as progress.” – Mike Homer to me in 2007

“I’m always amazed how these overnight successes take a hell of a long time.” – Steve Jobs

When you ask people to name a few companies when they think of Silicon Valley, Intel often pops up due to both its commercial success and the brilliant “Intel Inside” marketing campaign.

Intel was co-founded by Gordon Moore (the namesake for “Moore’s Law”) and Bob Noyce, and later led by the legendary Andy Groves. It is rightfully known as a powerhouse in Silicon Valley. Moreover, Intel’s chips were the brains for the PC, essentially providing the “arms” for the Computer Revolution.

With companies and with people, you get better or get worse, but you never stay the same. Alas, while Intel is an impressive company with $140 billion market value and 120K employees, a rival most regular people have never heard of has nearly a 10X greater market value. We’re talking about NVIDIA, which has exploded to a $1.1 trillion market cap and has become one of the five most valuable companies in the U.S.

NVIDIA is the primary supplier of Graphic Processing Unit (GPU) chips that power the Generative AI boom…essentially selling “picks and shovels” to the AI miners. Last week NVIDIA reported a monster second quarter, with revenues up 101% to $13.5 billion and EPS up 429% to $2.70. All financial metrics massively beat Wall Street estimates.

Like most all “overnight success” stories, NVIDIA took decades before it was recognized for what an incredible franchise it was building. While it was the #1 performing stock in 2001, 2016 and was one of the top 25 companies of the last decade as noted in last week’s EIEIO, it’s done this in relative anonymity.

Today, there are 4 million developers and 40,000 companies using NVIDIA to accelerate computing.

Started on a napkin at a Denny’s diner in San Jose in 1993, the founders’ (Jensen Huang, Curtis Priem and Chris Malahowsky) vision was to bring 3D graphics to gaming and multimedia. They chose the name NVIDIA as a nod to invidia, the Latin word for envy.

The NVIDIA startup journey took the usual twist and turns but stayed consistent and committed to its North Star that had been defined over scrambled eggs and bacon. As par for the superstar course, NVIDIA survived three near-death experiences over the course of its multi-decade rise. CEO Jensen Huang shared these nearly-fatal encounters in a recent commencement speech at National Taiwan University in May:

One of my favorite stories about the importance of discipline and utter commitment to a North Star was told by Jim Collins. It compares two explorers, Roald Amundsen and Robert Falcon Scott.

In October 1911, Amundsen and Scott led two parties on a journey, both with the goal of being the first to make it to the South Pole. Both left on the 1,400 mile round trip journey within days of each other. Obviously, no satellite phones, no GPS. Just a sled and some huskies.

Amundsen’s TEAM’s plan was to travel approximately 15 miles a day – come hell or high water. Scott’s TEAM’s strategy was to go as far as they could when the weather conditions were right, and to stay put if things were a little dicey.

Long story short, Amundsen’s TEAM beat Scott’s to the South Pole by 34 days. Not only did Amundsen succeed with the spoils that went along with that, but Scott’s TEAM of 5 all died on the trek back.

When comparing the journals of Amundsen and Scott, for the exact same days, Amundsen’s would say things like, “the weather outside today was challenging with cold and brutal wind, but we trudged on.” Whereas Scott’s entry would say “Today we decided to stay put and wait for the weather to improve before we moved forward.”.

The same weather, but different attitudes about how to respond to it. Amundsen clicked ahead 15 miles whatever the outside circumstances were – that was the plan, and they stuck with it. Scott let the “uncontrollables” control him, and ultimately kill him.

Both as entrepreneurs and investors, being systematic and strategic towards the objectives is how we win the race. And disciplined, humble and accountable with our attitude.

Market Performance

Much attention was given to the first Republican Primary debate in Milwaukee that had eight candidates vying for American’s attention. Despite others constant attacks, the clear winner was 38 year old political novice and entrepreneur Vivek Ramaswamy. The elephant not in the room was former President Trump who decided to have a one on one with Tucker Carlson on X…the social media platform formerly known as Twitter.

While President Trump, for better or worse, is a ratings machine, the over 250 million impressions he received for his interview versus the 12 million people who watched the debate on Fox, says a lot about the future of media.

For the week, the NASDAQ and S & P 500 snapped a three week losing streak and were up 2.3% and .8%, respectively. The Dow slid .4%.

Jerome Powell gave a talk in Jackson Hole Friday the Markets liked articulating the strength of the U.S Economy and robust consumer spending while reiterating commitment to a 2% inflation target.

The BRICS (Brazil, Russia, India, and China) pact met last week and have invited Saudi Arabia, Egypt, Argentina, Ethiopia, Iran and the U.A.E. To be part of that group to compete with the West.

With another notch towards India’s ascension on the World stage, it successfully reached the Moon with its Chandrayaan 3 mission.

Twillio, the automated communication software for enterprises, said they were putting a “nutrition label” on their AI products…expect more of these type of proactive alerts.

We remain optimistic about the outlook for growth stocks and believe there continues to be upside for many of our favorites. Accordingly, we are BULLISH.

The Weekly Rap

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Need to Know

READ: AI startups: Sell work, not software

LISTEN: Lee Ainslie - Hedge Fund Maverick

WATCH: Nvidia: The GPU Company (1993-2006) & Nvidia: The Machine Learning Company (2006-2022)

GSV’s Four I’s of Investor Sentiment

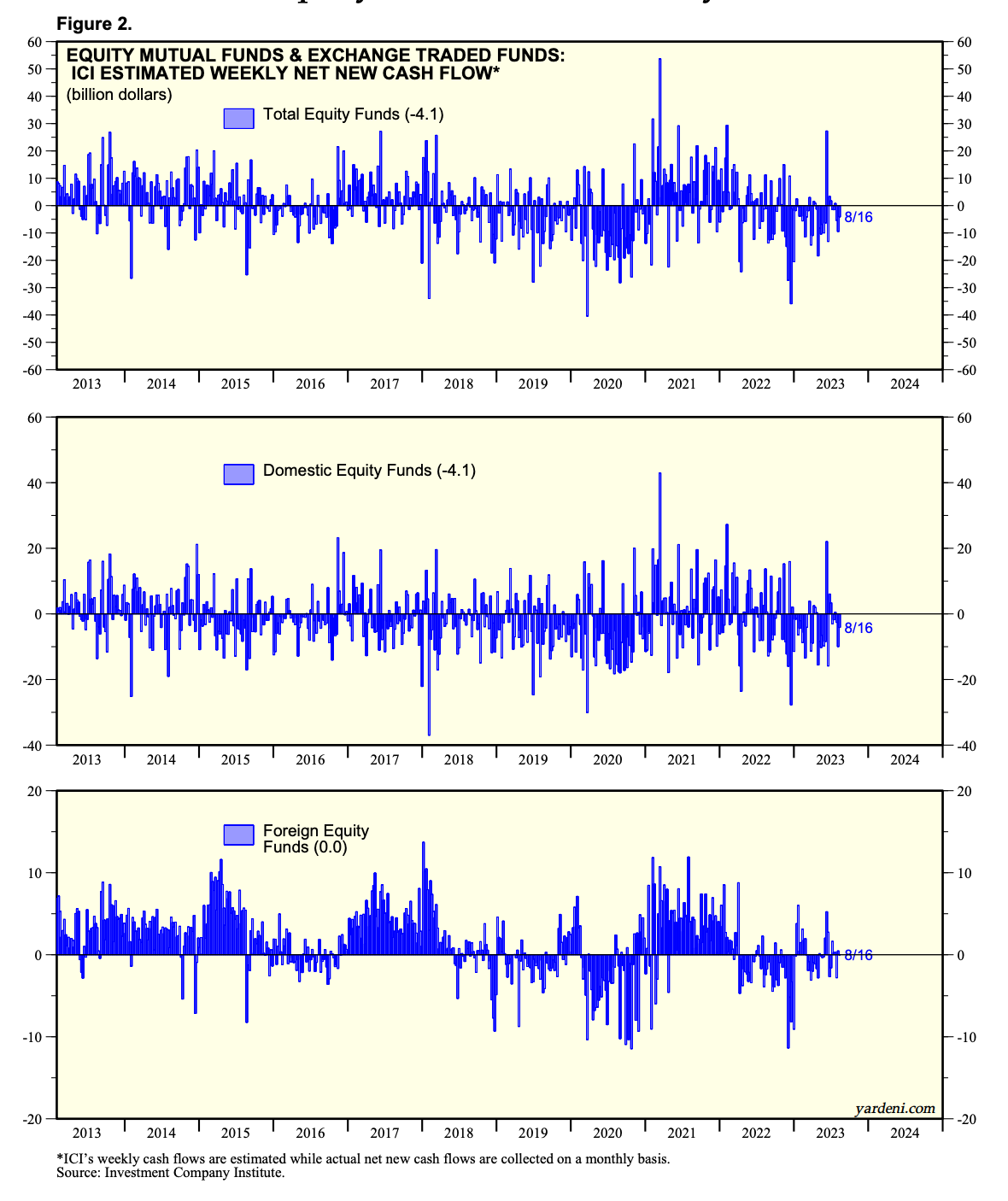

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

The IPO market is getting ready to roar. Instacart and Klaviyo both filed their S-1’s on Friday. Klaviyo did $585M in revenue growing 57% Y/Y, with 8% positive FCF and 119% NDR.

Source: The Information

#3: Interest Rates

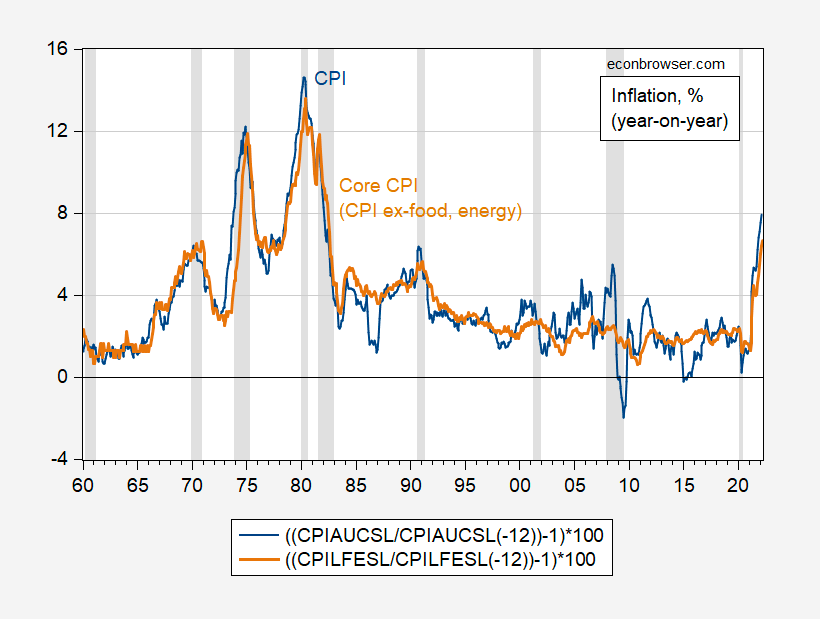

At Jackson Hole, Fed Chair Powell warned that inflation was still too high and shared that the Fed is prepared to raise rates if needed. Markets are roughly split 80/20 on staying at the current rate or an additional hike at the next meeting in September.

Source: CME

#4: Inflation

In the United States, investors appear to put high odds on inflation being above target at around 3 percent ...just shy of the average of 3.8% from 1960 – 2023.

Source: Econbrowser

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 1 – number of new unicorns in India so far in 2023 (Axios)

Innovation: 1.1% – percent of companies backed by VenCap from 1986 –2018 that returned the fund (David Clark)

Education: 125,000 – number of microschools that exist in the USA (WSJ)

Impact: #1 – “Sad” is the most searched for word among Gen Z on Spotify (Spotify)

Opportunity: 62% – percent of new founders in 2023 that live in one of 25 cities (LiveData)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM