“How many people work at Google? About Half.” – Anonymous

“As an expert attorney, you may be able to review one master service agreement better than anything on the planet. But if you’re asked to do that 100 times in a single day, you’re going to start missing things. The AI doesn’t get tired.” – Cai GoGwilt, Co-Founder of Ironclad

The hand of the diligent will rule, while the slothful will be put to forced labor. – Proverbs 12:24

Other than that, how was the play, Mrs. Lincoln?

In what nobody living has actually ever experienced, Silicon Valley Bank had a run on its deposits last Thursday with $42 billion dollars withdrawn against $200 billion of assets. By Friday morning, the government stepped in and took control of the bank.

Every crime needs a criminal and I’m sure in the days, weeks and months to come, there will be a slew of villains uncovered, but what is clear as day is the Innovation Ecosystem has taken a major blow. Some have called SVB the “plumbing” of Silicon Valley and as we know, when the plumbing breaks, it’s a S@#$ Show. Roughly 50% of venture backed companies had a banking relationship with SVB, as did many of the venture firms themselves.

E119: Silicon Valley Bank implodes: startup extinction event, contagion risk, culpability, and more

Silicon Valley Bank was founded forty years ago by Bill Biggerstaff and Robert Medearis who came up with the idea over a poker game. SVB’s big idea was to focus almost exclusively on the high tech industry and be deep in it (the other industry SVB focused on was the Napa Valley wineries which was another bonus for its customers). The timing was about perfect as Silicon Valley and venture capital were in their infancy and traditional banks weren’t set up for entrepreneurial businesses whose assets were in its IP.

The enterprise value of SVB grew in direct relationship with the growth in venture capital assets. An additional tailwind for SVB’s business model was that interest rates effectively peaked in the early 1980’s when the bank started, so the asset value of the securities continued to climb.

Source: FRED, NVCA, Pitchbook

While nobody forecast a run on the bank, in hindsight, some of the cracks that resulted in the implosion were obvious. SVB’s business was to take in cash from its VC and VC portfolio companies and turn around and invest in fixed income securities. The spread between what it paid for its deposits (typically 0%) and what it earned on its investments was its profit. After 40 years of declining interest rates, 18 months ago rates started to spike upwards. At the same time, the Venture Capital firms were raising less money which meant fewer deposits AND the portfolio companies were burning money faster and weren’t replacing the withdrawn cash with fresh proceeds.

Obviously, not an ideal situation but manageable unless somebody yells “fire” in a crowded theater. That happened Wednesday night as if we were watching “It’s a Wonderful Life” in real time.

WATCH: It's A Wonderful Life - Bank Run

As somebody said, if you panic, it's best to do it early. That was clearly the case last week.

Certainly my hope that cooler heads prevail and the mess that was created gets cleaned up quickly…it seems like that will be the case. Tonight, the Department of the Treasury, Federal Reserve, and FDIC issued a statement that guaranteed the deposits of all SVB customers, starting Monday.

The first 29 Days of November were one to forget for the Innovation Economy. The FTX fraud and Crypto Collapse shocked the entire tech ecosystem. Growth stocks continued to get hammered while interest rates continued to rise.

Sentiment on Sand Hill Road was bleak. And just when almost all hope had disappeared, OpenAI published a blog post “Introducing ChatGPT” on November 30th.

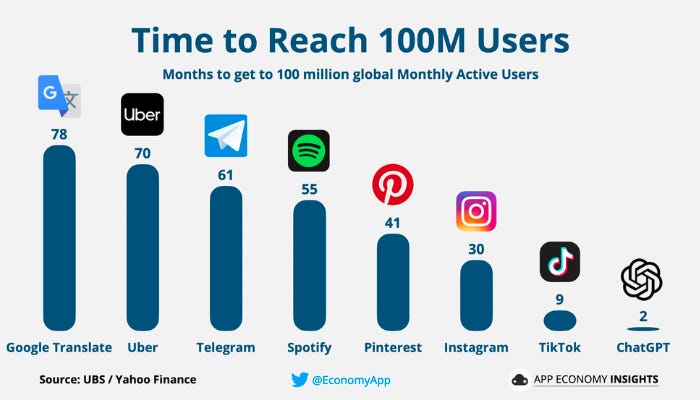

Since then, the technology world has been up and to the right. ChatGPT is the fastest growing consumer product in history. In 5 days, ChatGPT crossed 1 million users…7 weeks later, it hit 100 million users. For context, it took TikTok almost five times longer to reach that same milestone.

ChatGPT wasn’t just another product launch. It was the culmination of 10+ years of AI Hype and the search for the next innovation cycle. 5 years earlier, Andrew Ng declared that “Artificial Intelligence is the New Electricity,” but it didn’t hit the “boiling point” on AI until ChatGPT.

Since then, the rapid development by innovators, incumbents, and investors has been astonishing: we’ve gone from a grudge match to an all-out shootout.

Last week alone, there were 100+ new AI products released, while everyone from Snap to Salesforce announced a ChatGPT API integration. Since the Generative AI genre was created, 500+ startups have collectively raised over $11 billion. It feels like we now have a “ChatGPT for Everything,” from cooking to coaching to comedy. Friction is being removed and accelerants are being added daily.

Top Generative AI Companies To Watch

Top 10 Influential People in Generative AI

Yann LeCun, Chief AI Scientist at Meta

Andrew Ng, Founder & CEO Of Landing AI

Daphne Koller, Founder & CEO of insitro

Sam Altman, Founder & CEO, OpenAI

Yoav Shoham, Co-Founder, AI21 Labs

Clement Delangue, Co-Founder & CEO, Hugging Face

Alexandr Wang, Founder and CEO, Scale AI

Aidan Gomez, Co-Founder & CEO, cohere

Noam Shazeer, Co-Founder and CEO, Character.AI

Mustafa Suleyman, Co-Founder, Inflection AI

Two more announcements from OpenAI will turn up the heat on the Generative AI excitement even further.

Last week, OpenAI announced the ChatGPT API, which allows developers to add ChatGPT to their apps…at 90% less than the cost in December.

Next week, OpenAI will release GPT 4. GPT 4 will be multimodal, meaning that it can translate text into multiple formats (video, images, sound) and languages (e.g. it can receive a question in Spanish and answer in Japanese).

While all these announcements make it seem like the AI arms race is a sprint, we’re betting it will look more like a marathon. There’s a term in Track & Field called “The Bell Lap”... it’s the moment when the top runner hits one lap to go and, frankly, all Hell breaks loose.

While being the first one to the bell is a good sign, it doesn’t necessarily mean you’ll win the race. And if AI is anything like Search, the “first mover advantage” that Infoseek and Alta Vista had might turn into more of a first to move, first to lose situation. Or as we like to say, the early bird gets the turd.

Most Popular Search Engines 1993-2021

If getting to the bell first won’t crown the winners, what will? Whoever has the best system to get the most proprietary data. Wall Street has recognized the power of proprietary data for decades; now Main Street has. In fact, there’s a new corollary for the Golden Rule (i.e. he who holds the gold makes the rules)…the Data Rule. He who has the data rules.

In a world where your data is your destiny, who will be the winners? So far it seems like it won’t be products…it will be platforms. Quora has the Internet’s best answers on the Internet; now they have Poe. Duolingo has the world’s best language learning data; now they have Duolingo Max. HubSpot is the home of marketing and sales; now they have Chatspot.

The “elephant in the room” for OpenAI is their blatant use of third-party data to power their products. Clearly they’re operating under the YouTube principle of asking for forgiveness rather than permission.

As Warren Buffett famously said, the market is a voting machine in the short term, but a weighing machine in the long term. It’s similar when we talk about knowledge and technology. Knowledge capital in the short term is a voting machine, but in the long term it’s a weighing machine…and what it weighs is all of the evidence.

ChatGPT is a voting machine: it turns infobesity into instantaneous information – but that information is a commodity. Instead, the real value is in insight. That’s where we’ll see the difference between companies with AI DNA versus companies wearing AI lipstick.

The business stakes for AI are clear, but the stakes are just as high for culture and society at large.

The nearly industry-wide layoffs in tech over the past year revealed the institutional bloat that companies (both old and new) accrued over the course of a years-long bull run in an interest-free environment. Companies were told that growth had to be their number one priority, and many executive teams put this into action by hiring hundreds of individuals with narrow (or as they like to say, “hyper-specialized”) skillsets and adding depth to their benches of those who make up the “email caste”.

The total number of individuals laid off across Amazon, Microsoft, Google, Meta, Snap, Twitter, and Doordash in the past eight months would just barely fit inside SoFi Stadium.

However, as a user, I can’t say I’ve experienced any differences in the performance or service of any of the above companies. It’s my view that the contagion of layoffs was the cover that many tech companies needed to let go of clearly non-mission critical workers.

You can’t blame the specialized tech workers, though. Some employers drank the kool aid and made sure that their offices were “spaces for authentic self-expression” and nodded along as they employed countless people who were simply there to “rest and vest.”

At many of these businesses, successfully navigating the interview process would be the biggest grind of their life at the company. Plus, they had spent all of high school and undergrad with endless people telling them to “learn to code” and they had done just that. In many cases, their singular focus prevented them from seeing the forest for the trees.

When the music stopped on Sand Hill road in 2022 and VC coaching went from “grow at all costs'' to “get lean and seek profitability”, many of the first people to go were those who were essentially the fourth-string (for example) UI/UX designers who spent much of their time with Figma open on one monitor and Buzzfeed on the other.

As Malcolm Kyeyune stated in his November piece for Compact, “One of the biggest and least-talked-about social questions in the West is how to economically provide for our own modern version of France’s impecunious nobles: that is, how to prop up high-status people who can’t really do much economically productive work.”

HBO’s Silicon Valley: Hooli Employees “Resting and Vesting”

The ones who survived their company’s layoffs were those who could prove that they were truly valuable. These were the 10x engineers, the 10x designers, the 10x data scientists. For all of the above knocks on specialized roles, there is absolutely value in learning hard skills like coding, statistics, data science, financial modeling, and design. We’ve already seen this play out at Meta, where Zuck announced that most of Meta’s middle managers would transition to an “individual contributor” role at the company…or leave all together.

However, those who were laid off after narrowly focusing on just one of the above skills will face tough sledding ahead as many of those functions will be replaced or heavily augmented by AI. This will likely mark the end of big tech engineers making millions (let alone having 10 jobs), as a single 10x developer in 2030 will be able to do the work of 100 developers today.

As The Hill contributor Kristin Tate wrote in her piece this week, “We are entering into a world where general knowledge will be known mostly by machines and practical knowledge still will be implemented by human hands . . . Many people who invested their time and careers into a certain profession will undergo a collective identity crisis.”

Specialists had a nice run, but over the next 10 years, value will shift back towards Renaissance (Wo)man in the workforce who can adapt, think critically, and creatively provide value across a multitude of functions. A “Renaissance (Wo)man” is not to be confused with a “jack of all trades and a master of none.” Those who can master the new AI-powered tools at their disposal will be the ones who achieve unprecedented levels of productivity. Their full arsenal of skills will prove far more valuable than their peers who brought one single extremely sharp knife to a gunfight.

In 1930, the American Federation of Musicians launched a campaign against the use of “canned music”. This came in response to the arrival of synchronized recorded music, a technology that the federation argued cheapened the art created by human musicians performed live.

While some artists perceived this to be an assault on musical culture, others leveraged synchronized music to create new businesses (RCA launched the first commercial vinyl long-playing record in 1930) and entire genres that were embraced by the public. These artists recognized the inevitability of the technology in their industry, acted upon it, and used it to make transformational change.

Ruthless market forces create an efficiency towards all things cheaper, faster, and better. These forces are catalyzed in times of duress, distress, and opportunity. The future belongs to those who navigate this brave new world in the most effective way.

Market Performance

Stocks had their worst week of the year after SVB’s stunning collapse. NASDAQ fell -4.7%, the the S& P 500 was down -4.5% and the Dow dropped -4.4%. The SPDR S&P Regional Banking ETF was down -16% this week, while the Renaissance IPO ETF fell -9.2%.

While SVB obviously stole the headlines, “Macro Malaise” is still top of mind from Washington to Wall Street. Before SVB collapsed, odds of a half-point rate hike at the next Fed meeting were priced in at 70%; now it’s a 60% chance of a quarter-point hike.

US-China tensions continue to rise, as Senators introduced the Restrict Act, a bipartisan bill that would give President Biden the power to ban Chinese apps posing security threats, including TikTok. Meanwhile, China is setting up a new financial regulator to tighten the oversight of its Banking and Tech sectors.

In Tech World, Apple launched a new music service, Apple Music Classical, while Spotify announced a redesigned feed with a Tiktok-like discovery homepage. Meta is working on a decentralized text-based app (aka a Twitter competitor) code named P92, while former Instagram founders Kevin Systrom and Mike Krieger’s customised news app Artifact went live.

Warren Buffett famously said that “bad news is an investor’s best friend.” What’s less well-known is the second half of the quote – “it lets you buy a slice of America’s future at a marked-down price.” It’s obviously been a tough week for Silicon Valley and the Innovation Economy, but we remain as bullish as ever long-term in America’s potential and the “stars of tomorrow.”

GSV’s Four I’s of Investor Sentiment

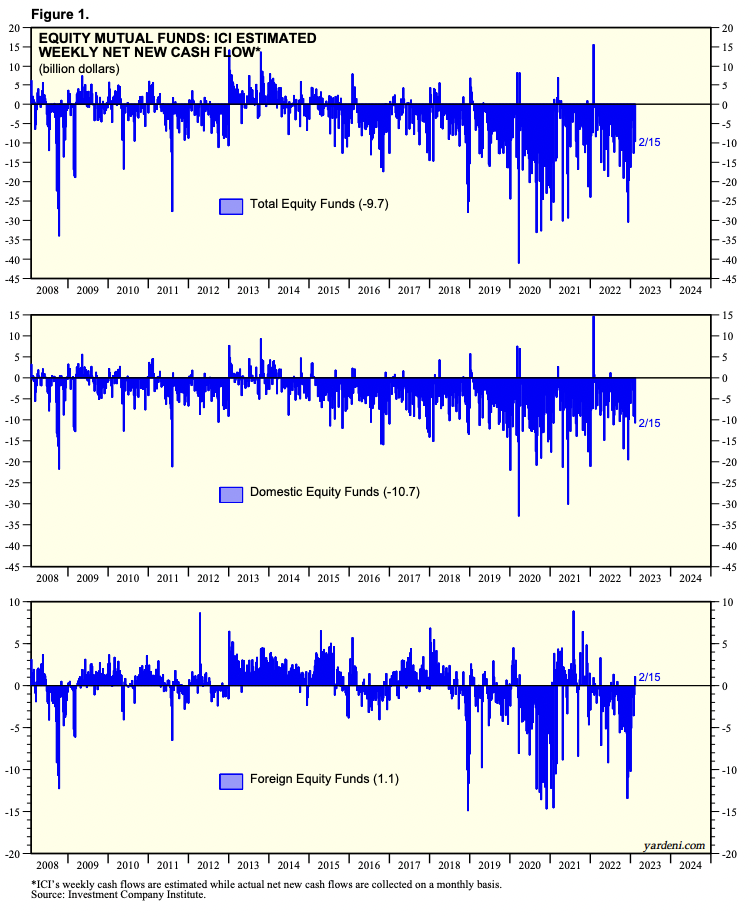

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

The US IPO market remains quiet, but fast-fashion empire Shein – which has grown over 100% for eight straight years – is looking to pursue a US IPO later this year.

Source: Renaissance Capital

#3: Interest Rates

Last week, markets sold off as investors bet that the Fed will take rates higher and longer than expected. Expectations for the peak fed funds rate, shifting to an expected range closer to 5.5%-5.75%, up from 5.0%-5.25% at the start of the year.

Source: Edward Jones

#4: Inflation

The Fed is still committed to its 2% inflation target..and is hiking rates accordingly. . Before SVB collapsed, odds of a half-point rate hike at the next Fed meeting were priced in at 70%; now it’s a 60% chance of a quarter-point hike.

Source: Edward Jones

Chart of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 2 million — amount of paid subscribers on Substack (Source)

Innovation: 30%— percent of YC companies exposed through SVB that can’t make payroll in the next 30 days (Source)

Education: 72% – percent of American parents that support school choice (Source)

Impact: 100x — undergraduates at Columbia are 100x more likely to belong to the top 0.1% of families by income than to the poorest 20% (Source)

Opportunity: 7 in 10 – people across industries that define their purpose through work (Source)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM