GSV’s weekly insights on the global growth economy. Join 27,000+ readers getting a window to the future by subscribing here:

“Of all the small nations on Earth, perhaps only Ancient Greece surpasses the Scots in their contribution to mankind.” – Winston Churchill

“There are two seasons in Scotland: June and Winter.” – Billy Connolly

“Conformity is the jailer of freedom and the enemy of growth.” – President John F. Kennedy

When I was a young research analyst, my job was to discover rapidly growing small companies and pitch them to institutional investors. To me, not a better job could exist. I got to spend all my time speaking with the founders of young, dynamic enterprises and growth portfolio managers.

There were two places on Earth that had an outsized contingent of savvy investors who were looking to invest in the fastest growing businesses in the World – San Diego, California, and believe it or not, Edinburgh, Scotland.

San Diego made sense. Located on one of the most picturesque places one could imagine with perfect weather, it was logical that free thinking, “big idea” people would congregate there. Great firms like Nicholas Applegate, Duncan Hurst, Pacific Century and Wall Street Associates were all there (Wall Street Associates was named after the other Wall Street, the one located in La Jolla overlooking the Pacific).

Five thousand miles east in Edinburgh, Scotland you could find a similar group of growth gunslingers. Instead of polo shirts, perfect tans and chinos, the boys of Scotland wore kilts, were challenging to understand, and only saw the Sun when they went on vacation.

Once you arrived at the Edinburgh airport, sheep were the first thing you saw as you exited. As you approach the city, which was the home of the moral philosopher and economist Adam Smith, the imposing Edinburgh Castle stares down at you from the cliff above. One can picture the castle's defenders pouring hot oil on would-be invaders scaling the walls.

While it was highly unlikely that the San Diego and Edinburgh portfolio managers shared the same haberdasher, they did share a passion for fast growing companies – the faster the better. The great firms of the day included Walter Scott, Martin Currie, Scottish Widows and Orphans (ironic for a group that loaded up on high octane, hyper growth companies) and Baillie Gifford.

Alas, over time, many of the legendary firms that were based in Edinburgh either shut down, overcome by their own success, or moved to London.

One bucked the trend and remained in the land of the Caledonians, and that was Baillie Gifford. If there is a better global growth investor on the planet, we aren’t sure who it is.

Accordingly, it was with great anticipation when we recently attended their United States roadshow where they shared their thoughts on their philosophy, the market, exciting industries of tomorrow, and companies they were bullish on.

Source: Fintel

A few fast facts on the firm: UK-based Baillie Gifford is a large-scale investment business that has remained an independent private partnership, with 57 partners who own the firm.

Their largest client, the Scottish Mortgage Investment Trust, has been managed by Baillie Gifford for well over a century.

This long-term capital base allows the firm to invest with a lengthy time horizon (10+ years) compared to their peers who compete on a quarterly or annual basis. The firm has 1,814 employees (and 383 investment professionals) and nearly $300 billion in AUM across 725 clients.

Below are the GSV Team’s 10 Takeaways from the event:

At The End Of The Day, It’s A People Business

Baillie Gifford’s investing philosophy and recruitment process is designed around the principle that excellent people are what drive exceptional returns.

They believe that far too many investment teams study the same topics, attend the same universities, and socialize in the same circles. Baillie Gifford has a contrarian philosophy – they feel that following the investment industry ‘herd’ is the worst way to try to predict where the world will be in 10-15 years.

The large majority of Baillie Gifford’s investment team is far from Wall Street at their HQ in Edinburgh, Scotland and they have an additional research team in Shanghai, China. They currently have a new office space in Edinburgh in the works. Employees are consistently in the office 4-5 days a week, with 1 month per year allocated to working wherever they want. As Blackstone’s Jon Gray put it to Ron Baron, “The Yankees play in Yankee Stadium.”

Baillie Gifford’s hiring process is focused on new grads, with 80% of their investment managers starting directly out of school. Their primary filters are (1) academic excellence in any field and (2)an insatiable curiosity about the world. A large majority of their hires did not study finance and have no prior experience investing.

Each analyst participates in a five year training program – three one-year rotations with different teams before finishing with a two-year placement on another. Analysts can also choose a “pet project” where they can research an area of interest (similar to Google’s 20 Percent Time). This initiative gave way to the creation of Baillie Gifford’s space franchise and subsequent investment in SpaceX.

2. For a Great Growth Company, Business Model and Technology Model Need to Align

Baillie Gifford seeks out the world's fastest-growing businesses with the potential for long-term growth.

Their benchmark is a business that will double in 5 years (~15% compound annual growth rate), but their goal is to find businesses growing 25-30% (or more) for a sustainable period.

The Baillie Gifford team emphasized how critical it is to have a business model and technologically innovative product that are aligned with how the world will evolve in the next 10-15 years. Having one of the two is good, but you need both to have a truly great growth company.

One example the team consistently mentioned was SpaceX. Before SpaceX’s reusable rockets, space was a “cost-plus” industry. Products were essentially designed for politicians, rather than for engineers. SpaceX flipped that paradigm on its head, making rockets depreciable rather than disposable. This has lowered costs dramatically and allowed for entire new platforms (e.g. Starlink) to emerge.

3. When It Comes To Management, What You Ask Is What You Get

Baillie Gifford focuses on being “patient capital” and having long-term relationships with management teams who think (and act) like owners. They are more concerned with management's long-term vision for the business than with whether they will hit their earnings this quarter.

During the diligence process, they dedicate lots of time to understanding the TEAM they’re investing in and what drives them, both personally and professionally. They ask some unusual questions – what books they read, where they live, what their homes are like, whether or not they own a boat, whether or not they own a plane, where they go on vacations, etc.

Baillie Gifford believes these unique lines of questioning allow them to understand management teams’ values and enable them to judge tolerance for stress and risk.

Willingness to take risk is one of most important factors Baillie Gifford screens for, in both management and company culture. Two of the key indicators they assess for this in a business are (1) investments into R&D and (2) human capital dynamics.

Any business investing major dollars into R&D (rather than paying out larger dividends, for example) is taking risk – but this is how growth businesses invest in change, which helps them win big in the long term.

R&D as % of sales is a key metric that Baillie Gifford tracks: it’s 16% for their Long Term Global Growth (LTGG) fund – contrast that to 3% for the MSCI World Index. Furthermore, it’s getting more and more difficult for incumbents to invest in R&D, as corporate debt burdens for the S&P 500 have grown from 28% to 38% over the past decade.

Regarding key indicators in human capital, they track who’s getting hired, who’s getting fired, and who’s not getting fired.

Sidenote: Shoutout to our friends at Live Data in Santa Barbara, CA whose real-time human capital data provides detailed company insights at the employee level.

As we say at GSV: human capital leads to financial capital, financial capital leads to returns, and returns attract more talent.

These data points can say a lot about a business. For example, 15 years ago, Meta was hiring mission-driven employees who wanted to work at a dynamic, disruptive startup. Today, it would appear that they are hiring 9-5ers who want major employee perks and benefits. To get an even more accurate pulse on the most dynamic companies in the world, Baillie Gifford tracks alternative data sources looking at employee sentiment as well.

Together, these indicators provide a snapshot into how an organization is designed, the values that its employees have, and the mission that they’re working towards.

4. Edge is Behavioral and Informational, Not Analytical

The firm shares Bill Miller’s definition of the three forms of edge – analytical, behavioral, and informational. They think two of the three are needed to beat the market.

To have an analytical edge, it takes having the smartest people. Baillie Giffford tries to hire world-class investment talent straight out of school (and widens the aperture beyond the traditional “path” of finance major to investment banking to private equity). However, they think it's impossible to truly measure how intelligent their TEAM (or any TEAM) is, so they don’t try to compete on that dimension.

To have a behavioral edge, it takes having conviction in your best ideas (large position sizing, high active share) and the courage and patience to hold them (stomaching drawdowns and volatility). The average holding period for a stock is <12 months…the firm’s target is >5 years.

To have an informational edge, it takes generating differentiated insights (before Sarbanes-Oxley, the informational edge became a lot different). This comes from the firm’s research process (see #5).

5. Ignore the Headlines, But Talk To The Journalists That Write Them

The firm believes that competing on a quarterly or annual basis is a losing game. Furthermore, they do not read most sell-side research, as (1) quality has decreased due to changes in human capital dynamics in the investment research business and (2) sell-side analysts are incentivized to facilitate trades vs. taking a long-term view on businesses.

Instead, they focus a majority of their research consumption on (1) academics and (2) journalists. Academics provide a “Window to the Future” on early technological breakthroughs and the companies that will make them possible. Their partnership with the Santa Fe Institute led them to investing in Tesla.

Journalists are trying to write something interesting, novel, and true…they’re essentially research analysts without trying to solicit a trade. The team finds journalists especially helpful in emerging markets, where information can be extremely limited in some areas. Journalists aren’t incentivized to pick winning stocks…but they are looking to discover the truth.

6. All The Game Is In The Few

Baillie Gifford partnered with ASU Professor Hendrik Bessembinder to study the long term performance of stocks vs. treasury bills. Their finding is that public markets are governed by a “power law” phenomenon similar to venture capital.

Since 1926, just 86 stocks have accounted for half of the entire stock market’s total wealth creation ($16 Trillion) over the past 90 years. All of the wealth creation can be attributed to the thousand top-performing stocks, while the remaining 96 percent of stocks collectively matched one-month T-bills.

From 1990 – 2018, out of the 60,000+ public companies worldwide, 61% of firms destroyed value, 38% offset value destruction, and 1.3% of all firms (~600) drive all net worth creation. Put another way, around 600 companies accounted for all the outperformance of equities over the past 30 years.

There are two ways to own these companies – (1) own the market through index investing and (2) own the world’s best companies through concentrated growth investing.

Option (1) ensures you own the best companies, but at the price of owning every company. Because 98% of the market doesn’t beat T-Bills, you essentially accept equity-like volatility with T-Bill returns.

Jack Bogle, Founder of Vanguard and Father of Index Investing

Option (2) requires you to pick winners, but gives you enough meaningful exposure where you’ll participate in the outperformance of the top performers. That’s the opportunity for a long-term, long-only growth fund like Baillie Gifford.

7. Sector Specialists Can Get Stuck In The Sand

Disruptive innovation cuts across different industries. Being focused on one particular sector (e.g. healthcare, financials, education) can make you an “expert,” but can also make you miss the forest for the trees. For example, the world’s biggest enterprise software success (AWS) came from a retail company (Amazon).

Most “experts” tend to explain why not rather than why. When Ron Baron invested in Tesla in 2012, nearly all the Tesla skeptics were automotive investment analysts, whose expertise on engine manufacturing would become obsolete if EVs became prevalent. Only 1 of 19 analysts who published a research report with a sell recommendation on Tesla had met with Elon Musk; only 3 had visited its Fremont factory; and none had visited its huge facility in Reno.

Most market participants are culturally and cognitively alike…this is even more of a challenge in sector specialist research teams and investment firms.

Take Baillie Gifford’s space franchise as an example. One of their private investments, Astranis, has a novel approach to internet satellites that instantly upgrades connectivity from 2G to 4G in emerging markets. This will have spillover effects across all sectors (e.g. powering education in areas that have never had broadband).

8. Exponential Change Drives Long Term Returns

There are four ways for companies to grow – disruptive innovation, “steady eddie” compounders, capital allocation, and cyclicals. Baillie Gifford focuses on #1.

Disruptive growth is certainly not linear. Humans have a hard time understanding this, and markets have a hard time pricing this.

Frameworks such as Wright’s Law (every time an industry doubles, costs decrease by 20%) drive Baillie Gifford’s research into the growth industries of the future.

The reality is that major cultural shifts can’t be neatly modeled in a spreadsheet. For example, Francois Pinault (CEO of Kering, which just acquired CAA) is very bullish on Roblox and virtual goods, and thinks it can be bigger than the IRL business for Kering.

9. Low Volatility ≠ Low Risk

Volatility is the friend of a long-term investor. Baillie Gifford takes the same approach when investing in growth companies.

Many of Baillie Gifford’s most successful investments (from Hermes to Dexcom to Tesla) have suffered 5+ 30% drawdowns over the past decade, yet compounded at a much greater rate.

MercadoLibre has fallen by more than 20% 12 times since 2010, but it’s been a 28X bagger.

Hermes has had plenty of drawdowns over the past decade, but the stock has grown at a 40%+ CAGR, with a decade-plus of double-digits earnings growth since the New York Post declared that Hermes “runs on ‘fumes.”

In fact, there’s a linear relationship between volatility and share price returns – companies that “roll around in the mud” are more likely to experiment and thus outperform the benchmark.

The only way to create exceptional returns is through extraordinary measures.

For example, over the past decade, Volkswagen hit 90% of earnings expectations, yet Tesla missed earnings expectations 90% of the time. The same thing was true for Amazon vs. Walmart from ~2003 to 2018.

10. Fundamentals, Not Fear, Drives Long-Term Returns

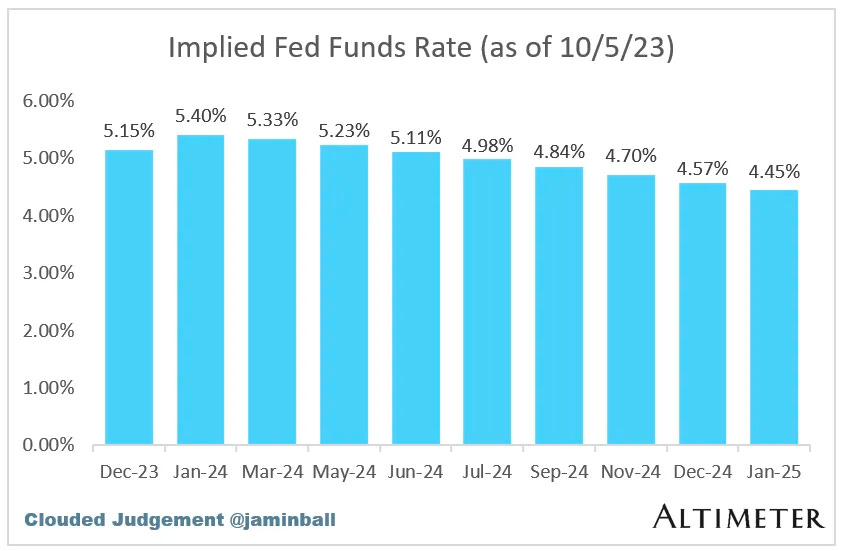

Higher rates are good for stock picking – innovation will unfold regardless of the macro environment on a 10 year time horizon.

Exponential change drives long term returns…not the Fed. In the short term, interest rates and inflation debates distract market participants like moths to a flame. In the long run, innovation drives growth and thus long-term outperformance.

Furthermore, many of these growth businesses are either (1) under-covered by sell side analysts (2) still “thrown out with the bathwater” after the COVID drawdown and (3) not meaningfully represented in the major indices and/or the Magnificent Seven (many of which are no longer high-growth businesses).

Even if rates remain high for a long time, there’s a generational opportunity for top growth names, many of which are doing 3x more revenue vs. 2020, yet share prices are at the same level as then. That sounds like an opportunity for us…and our friends in Edinburgh agree.

We are sickened and outraged by Hamas’ cowardly attack on the people of Israel over the weekend. As I write this, more than 900 Israelis have been murdered, and scores more have been taken hostage. There is no silver lining in this despicable act. There should be no confusion about who the victims are and who the evil doers are. I have many thoughts about how this could have been prevented, but rather than being accused of being political at this devastating time, the one thing I can say for sure is that we are all Israelis right now.

Market Performance

After struggling for the month of September, October brought life into stocks again catalyzed by a strong jobs report. For the week, Nasdaq rose 1.6%, the S&P was up .6%, and the Dow inched up .3%.

While many strategists were fretting over the potential of an upcoming recession (I guess they missed the one we already had), new jobs came in at 337,000 for September, almost double the projected 170,000.

A significant headwind is that interest rates have climbed to the highest levels in 16 years with the 30 Year US Treasury approaching 5%. It is also concerning that millions of student loan holders will be required to start paying again after a 3-year reprieve. There are 40 million people in the United States with student loans, owing a cumulative $1.6 trillion.

China’s economic growth forecast was ratcheted down from 4.8% to 4.4%. Beijing-based ByteDance, the proud parent of TikTok, reported a first quarter cash increase of $6.8 billion.

Another tidbit we found interesting – the gap between teachers salaries and other professionals is now the highest on record. People point out that teacher pay hasn’t kept up with recent inflation, but the more fundamental, systemic culprit is the mismatch between the importance of teaching and the teacher compensation system.

There is no shortage of uncertainty in the world today and there is a lot to be worried about. It can feel as though everywhere we look, we see messes without any capable clean up crews in sight – we wouldn’t be shooting straight if we didn’t acknowledge this. That said, opportunity is often created in moments where things seem to be most hopeless. Moreover, these risks are hardly a secret, and the fact that stocks aren’t going down means to me that they are looking for a reason to go up. We remain active in our hunt for the Stars of Tomorrow.

Maggie Moe’s GSV Weekly Rap

https://www.tiktok.com/t/ZT8rAxfLr/

Need to Know

READ: Private | No Mercy / No Malice

LISTEN Find Your X, Nurture Your N | Invest like the best

WATCH: Marc Andreessen: How Risk Taking, Innovation & Artificial Intelligence Transform Human Experience

READ: The Hyper-Personalization of Everything - Digital Native

LISTEN: More or Less Podcast Episode #17

WATCH: Peter Thiel: The Stagnation of Science and the AI Revolution

READ: Why I no longer hire from Harvard & Google | Late Checkout

WATCH: Going Deep: President & CEO of the National Football Foundation | Steve Hatchell

GSV’s Four I’s of Investor Sentiment

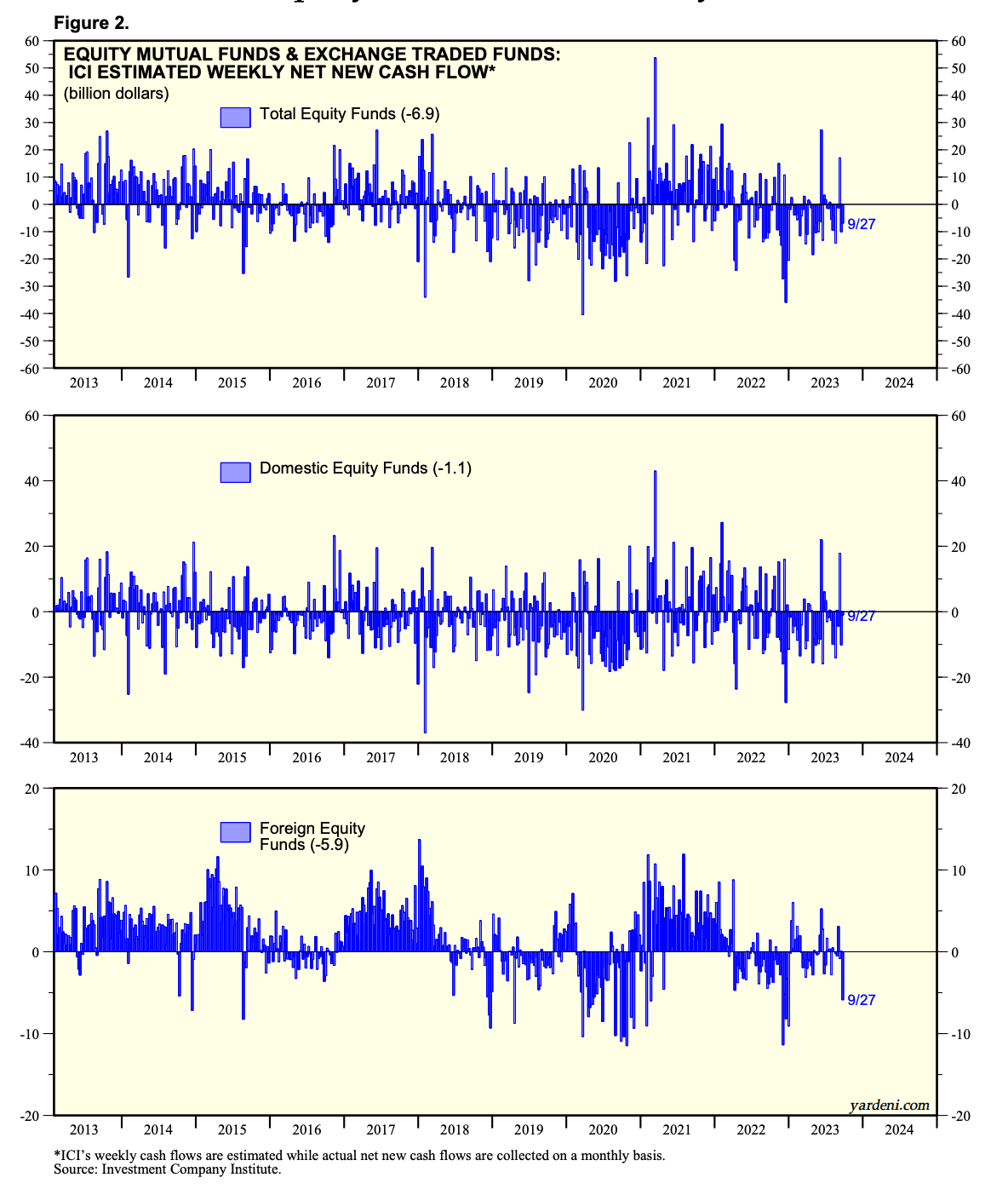

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Source: Renaissance Capital

#3: Interest Rates

Source:

#4: Inflation

Source: Edward Jones

Chart of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: $14.4M – median pre-money valuation for seed stage startups in Q3 2023 (Carta)

Innovation: 77% – Gen Z members that believe technology makes them feel more control of their finances (Harris Poll)

Education: 41% – young adults who think a college degree is very important (Unusual Whales)

Impact: 74% – Gen Z women that agree they “anticipate redefining my career as they grow as a person” (Harris Poll)

Opportunity: 79% – Americans favoring maximum age limits for elected officials (Pew)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM