GSV’s weekly insights on the global growth economy. Join 20,000+ readers getting a window to the future by subscribing here:

“Adults are always asking children what they want to be when they grow up because they're looking for ideas." - Paula Poundstone

"If you are not yelling at your kids, you are not spending enough time with them.” - Reese Witherspoon

“If I had asked people what they wanted, they would have said faster horses.” - Henry Ford

To see the future, study young people.

I vividly remember the first time I understood the true power of the Internet. I had my own “we’re not in Kansas anymore” moment when my then 7-year-old daughter Maggie went on Amazon by herself and used my credit card to order “the Babysitters Club.”

Shortly thereafter, Maggie and her younger sister Caroline demonstrated the power of eBay to me by “bidding” for Beanie Babies.

That was 1997. Today, eBay is a 22 billion dollar business, and Amazon’s market cap currently hovers at $1.5 trillion.

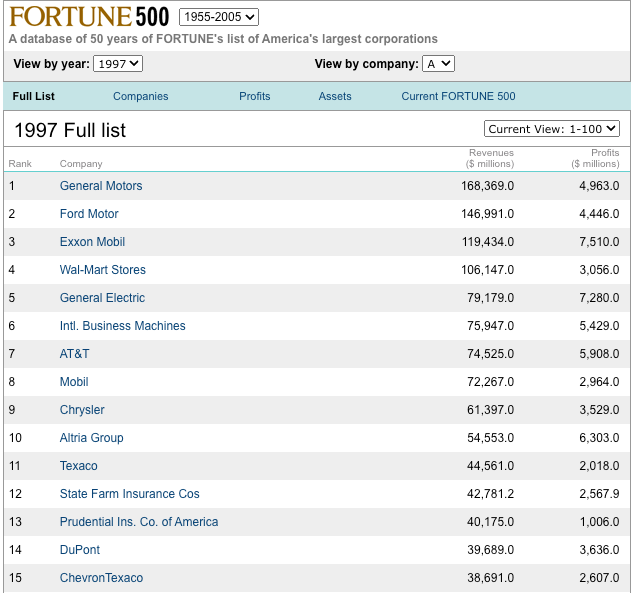

Looking back to 26 years ago, the businesses at the top of the Fortune 500 were industrial companies, brick and mortar retailers, and insurance firms.

In the two and a half decades that followed, many young companies have burst on the scene, become publicly traded, and delivered fresh oxygen to the market. Netflix, Google, Facebook, Tesla, Airbnb – none of which existed when my 1st grader introduced me to the world of e-commerce – have experienced explosive growth and have created a combined $3.5 trillion in market value.

Similar to the (albeit bizarre) trend of some older people getting blood transfusions from younger people in pursuit of youthful energy, when “fresh blood” arrives in the public markets, it often breathes fresh oxygen into it. The question is: where does one find it?

One place is in new IPOs; companies that have gone public recently. With signs of the IPO market door creaking back open after a brutal drought in 2022, new winners will emerge.

Dragoneer’s Marc Stad recently commented on IPO market cycles, explaining that it is prescient to keep a sharp eye on the first growth companies to come out on the other side of challenging IPO market periods.

Stad notes, “The banks aren't gonna take the worst companies first. They're gonna take the best companies first. You want to avoid the IPO market late in a cycle, you want to be all over it early in the cycle . . . When it comes, people will be too busy worrying about their portfolio and other things. But those who are laser focused, they'll find some great companies. And the banks will ensure that the buy side does well, and every—and there's nothing better for everyone than when an IPO happens and it goes up and to the right.”

Another place to look for guidance on where to find more of this “fresh blood”? The voices of young people.

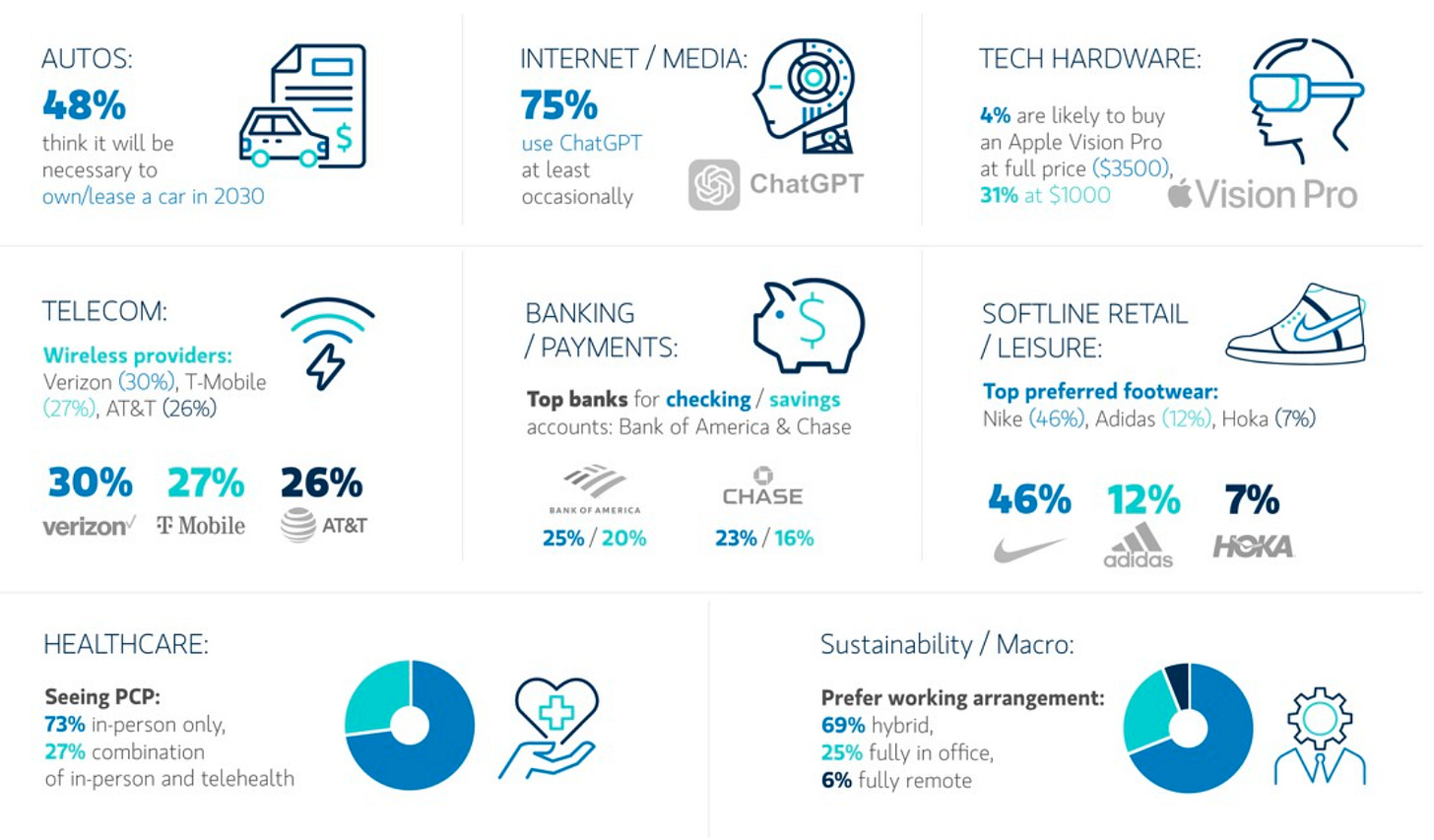

Morgan Stanley recently conducted its 5th Annual “Ask the Interns” survey, and while it's worth noting that investment banking interns certainly do not represent all of Gen Z, there are many insights to be gleaned from the responses. Nearly 600 summer interns shared their perspectives as consumers spanning across technology, retail, personal finance, healthcare, and more.

These undergrads love all things Apple…except for Apple Music (Spotify is just cooler). They have a declining appetite for Tesla as a brand – it was beaten out by Mercedes in terms of desirability – potentially because they view it as more of the next Toyota than the next top of the line luxury vehicle. However, Tesla does get love when it comes to prospective robo-taxi providers, where it is the company of choice by a long shot. These respondents buy with Apple Pay, but pay each other with Venmo. They may be heading towards embracing EVs, but they’re still much more likely to buy a hybrid for now.

Morgan Stanley’s report begins by saying, “To our interns: Investors should listen to you.” We agree – these are bright, talented and ambitious people; this data detailing their perspectives provides a Window to the Future.

Hot or Not: Intern Edition

Market Performance

The United States of America was downgraded last week. Fitch, a firm that 99.9% of the World has never heard of, created chaos when it took a notch of U.S. Treasury Debt from AAA to AA+.

While many, such as JP Morgan CEO Jamie Dimon, called the Fitch move “silly”, it’s not like the management TEAM of USA inc. is earning a lot of trust. $32 trillion in debt, allegations of a corrupt C suite and legal team, the Clown Show might be entertaining, but not confidence inspiring ... and credit is all about credibility. The choir is chirping about 4.07% 10 Year Yields, alas, that’s going to seem cheap unless we can get the banana out of the Republic.

Not a coincidence, the Dow fell 1.1%, the S&P 500 dropped 2.3% and NASDAQ was off 2.9%. Also a bit concerning was with 80% of the S&P reporting their results, only 59% of the companies beat the 2nd Quarter Revenue forecast. While that might not sound like a warning signal, in a healthy environment, we’d expect 80% or more of companies to exceed analyst estimates.

On the positive side of the ledger, Robinhood reported its first profitable quarter (and while we have questions on the model, young people love Robinhood), DoorDash had strong results and Uber also had its first profitable quarter. Of concern, Apple reported its third quarter in revenue decline.

On the horizon, ARM is looking to go public at a valuation between $60-70 billion…which would give SoftBank a mini-win after it purchased ARM seven years ago at a $32 billion valuation. The AI craze is undoubtedly a boost here but so is the incredible franchise and positioning of the business.

In what would have been one of the all-time great short opportunities (had it been public), HopIn, the virtual conference software platform’s assets were acquired by RingCentral. Nothing against HopIn, but the financing done at $6 billion by fancy investment shops reminds everyone that institutional investors are people, too.

Dicey times for sure, but we love the fact that people are scared. Accordingly, we can be proactive in looking for great companies that are selling at fair prices…and there are many out there. Time to pounce. Forward.

Need to Know

READ: WTF Happened in 2023?

LISTEN: Laela Sturdy (Managing Partner of CapitalG Interview)

WATCH: Last Lecture Series: “How to Live an Asymmetric Life,” Graham Weaver

READ: Giverny Capital Asset Management Q2 2023 Quarterly Letter

LISTEN: Founders: Christopher Nolan

WATCH: MongoDB CEO Dev Ittycheria on great leadership, building winning teams, and more

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Source: Renaissance Capital

#3: Interest Rates

The Fed’s Raphael Bostic said this week that US employment gains are slowing in an orderly manner and there is no need to hike rates further to ease inflation.

Source: Charlie Biello

#4: Inflation

Despite months of increasingly positive economic indicators, the American public remains negative about the state of the nation’s economy, with 51% saying they think the economy is still in a downturn and getting worse, according to a new CNN poll. 71% of Americans have had to change the groceries they buy in order to stay within budget.

Source: CNN

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 22% – percent of the top product-led startups growing at 75% or more this year, down from 49% of product-led startups two years ago (Zach DeWitt)

Innovation: 5.3% – startups on AngelList that raised a round or exited in 2Q23, the lowest rate ever observed (AngelList)

Education: 26.1% – journalists at the NYT or WSJ who attended an Ivy+ College (Opportunity Insights)

Impact: 27% – increase in job postings from 2021-2022 in electrification and renewables (McKinsey)

Opportunity: 13 – new female Fortune 500 CEOs in 2022 (Fortune)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM

Regarding "allegations of a corrupt C suite and legal team" -- what's really going on is that the GOP, addicted to Trump, has become a criminal enterprise and is projecting that onto the Biden administration, which is actually delivering governance, as a smokescreen on the truth. Straight out of Orwell's 1984 explanation of propaganda. The legal team is taking Trump down for attempting a coup on January 6. Read the indictment! Even legislators who said Trump did what he did in the immediate aftermath went back on what they knew when it became internally toxic for Republicans to take on the master -- to say the Emperor has no clothes!