“A penny for your thoughts.” — Sir Thomas More

“The propensity to truck, barter and exchange one thing for another is common to all men, and to be found in no other race of animals.” — Adam Smith

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.” — Ernest Hemingway

Introduction

The speed of business is the speed of trust. When the Federal Reserve Chairman and the Secretary of Treasury call inflation “transitory” and it’s actually clearly perpetual, it obviously hurts the confidence businesses have in the system.

In the exchange of ideas, suppressing views that are different or even offensive to one’s own, is bad for democracy. Cancel culture is a cancer and should be cancelled. Accordingly, Elon Musk’s purchase of Twitter was a victory for Free Speech and for the concept of an open Public Square.

Having a currency that can be traded in exchange for something else is dependent on trust and the integrity of the system. Money, reputation, knowledge, and goods etc. are all dependent on transparency of information and removing friction from making decisions.

Part 1: History

Currency and exchange have always been the engine of how society functions.

Way before Bitcoin, there was bartering. Bartering began in Mesopotamia in 6000 BC, where people traded goods and services for what you needed. Phoenicians adopted the concept to get food, weapons, and spices. Roman soldiers bartered their services for the empire in exchange for salt.

Bartering’s main benefit is its simplicity. Bartering does not require international trade, foreign exchange, or intermediaries. It can be as simple as “you give me meat, I give you milk.”

And while bartering may seem like ancient history, that’s far from the case. In 2019, the WTO reported that 15% of international trade worth $5.62 trillion was in the form of barter.

However, bartering has its downsides: every barter is a negotiation, so each party needs to build trust and agree to terms for each transaction. That’s a lot of friction for a global economy.

5000 years after the invention of bartering, a new form of exchange emerged: currency.

The use of currency can be traced back to neolithic China, where cowry shells were found as early as 11th century BCE. Occurring rarely in nature, cowry emerged as units of value. Historically, many commodities have served this purpose: tobacco, leather and hides, oil, meteorites… even giant stone disks.

The first metal money appeared in China in 1000 BC in the form of bronze cowries. Precious metals were least prone to fluctuation, compact in volume, and directly convertible to value.

By 500 BC, the first round coins were created in the kingdom of Lydia, which issued the first regulated coins. Durable, divisible, and portable, coins were standardized and eliminated the time-consuming practice of verifying the weight of rings or bars of precious metal. Soon, coins featuring royal symbols like emperors and gods were circulated around the world.

Over 2500 years later, we still put our idols on our currency:

As metal became more common, it encouraged the spread of markets. Governments were quick to embrace hard currency to facilitate tax collection and the build-up of military forces.

With the rise of Rome in the third century B.C.E., money became an important tool for unifying and expanding the empire, lowering trade costs, and funding the armies that kept the emperors in power. When the Roman empire started to decline, it coincided with a decline in the use of money.

Currency allowed people to trade in new places for new goods. According to the St. Louis Fed (more on the Fed later…), currency serves three primary functions: store of value (allowing you to defer consumption until later), unit of account (allowing you to assign value to different goods without having to compare them directly), and medium of exchange.

Paper currency was first used among Chinese merchants in 700 AD to avoid carrying thousands of coins long distance. It took the form of a promissory note, and eventually became nationalized by the government.

Paper notes could be issued irresponsibly, however. Devaluation, inflation and false notes could destroy a monetary system that printed more banknotes than there were coins to serve as backing. Eventually, paper notes grew in production to the point that the value rapidly depreciated. By 1455, the Chinese abandoned paper money due to over issuance, and wouldn’t return for hundreds of years.

Sweden’s first bank, Stockholms Banco, issued paper money in Europe in 1661, but when the central government started to mint coins of a lower weight than older ones, depositors wanted their old, heavier coins back. The result was a bankrun and liquidation in 1667, as well as the head of Stockholm Banco being charged and sentenced to death.

Similarly, in the American colonies, the Continental Congress issued paper money to pay military debts, but had too little gold to back it up, causing dramatic inflation.

Once paper currency was established, the next major shift was from commodity to fiat money. Commodity money is backed by precious metals such as gold, while fiat money is backed by “the full faith and trust” in the government that issued it.

For most of modern history, the idea of tying your money to the “full faith and trust of the government” seemed like a disaster waiting to happen.

Gradually, governments began to rely on three primary standards: the gold standard, the silver standard, and bimetallism. Taking on a supervisory role, governments set the weight and metallic composition of coins.

In 1821, Britain became the first country to adopt the gold standard. Other countries followed suit over the next few decades, facilitating the flow of goods among countries. But the international gold standard didn’t function ideally. From World War One to the New Deal, countries suspended the gold standard to better control domestic economies for war efforts.

The last recent attempt to maintain an international monetary system was the Bretton Woods system. Signed in the White Mountains of New Hampshire, the Bretton Woods agreement was signed in 1944 as World War II was being fought.

The Bretton Woods system maintained the convertibility of the US dollar to gold at $35 per ounce. Essentially, any foreign government or central bank could exchange dollars for gold.

The goal of Bretton Woods was that nations would spend less time meddling with their currency supply and more time increasing trade and capital flows.

Bretton Woods effectively created the international monetary order, but it came crashing to a halt in 1971. On August 15, 1971, the US government terminated convertibility of the US dollar to gold, which made the dollar a fiat currency.

The past fifty years have seen nearly every major currency shift from being a fixed currency to a free-floating currency. And while precious metals have continued to serve as a store of value (Gold’s market cap is $11T as of today), they’ve fallen out of favor in a world of floating currency.

Part 2: Problems Today

While there are benefits to fiat currency, there are two main problems with fiat currency today.

The first problem is the blurring of borders. Today’s economy is no longer limited to bartering with neighbors or even by a nation’s borders. Instead, it’s driven by global networks that are essentially their own economies. It makes sense to have a global currency.

The second problem is the misbehavior of governments. The “full faith and trust of the government” seems a lot less secure when the US government has $31T in debt, a currency that’s increased 18% this year, and a Federal Reserve that was printing $60 million every minute in 2020.

Where do we think all this is going? A digital currency for a digital economy. While lots of ink has been spilled about blockchain, it’s worth restating the big idea.

Blockchain gives us, for the first time, a way for one Internet user to transfer a unique piece of digital property or information to another Internet user, such that the transfer is guaranteed to be safe and secure. Everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer.

As we first discussed in 2017, while the technical nuances of Bitcoin’s protocol involve advanced math and cryptography, the fundamentals are strikingly clear. It’s a new way to create, store, and send money. And unlike Dollars and Euros, which are created by central banks and managed by complex financial institutions, Bitcoin is created and sustained by its users.

We wrote then that “Bitcoin is just the beginning,” as the underlying technology can be applied to all manner of “exchanges,” whether or not they’re related to money.

The consequences of this breakthrough are hard to overstate. The power of exchange has made every industry run faster, better, and cheaper.

While we’re bullish on the power of exchange, we’re not bullish on exchanges themselves, which are often built on manipulation and speculation. While not coincidentally at the peak of crypto pricing, the entire world learned about crypto exchanges from Matt Damon during the Super Bowl. Fortune wasn’t exactly correct this time around.

It’s worth hearing what one of the world’s best investors has to say. Here’s Albert Lin from Sequoia on their investment in FTX:

“Yes, crypto eventually could replace money, and, yes, it can eventually decentralize the web,” Lin says with a dismissive wave of his hand. “But all those things are not true today. And, so, what is the thing that people do today? They trade. And if people trade, and people like trading, what is the business model that will make tons of money? It would be an exchange.”

While we agree with Alfred that a crypto exchange is a compelling business model, we don’t agree that the enduring value of digital currency will be driven by speculation and trading.

Instead, we think that the next evolution of currency and exchange will reduce friction and create liquidity for everything we own, including our knowledge… which brings us to education.

Part 3: The Future of Education: Knowledge As A Currency

In a bartering economy, cowries and coins served as useful currencies. In today’s knowledge economy, human knowledge and intellectual capital are poised to serve as a new form of currency. It makes sense to replace the same diploma we’ve used for centuries to transfer and signal knowledge with an alternative that offers more security and liquidity.

Blockchain-based systems will reimagine the systems that govern everything we own, including our knowledge. While we’ve historically relied on universities and diplomas to be the gatekeepers of knowledge, that makes less sense in a world where talent is equally distributed, but opportunity is not.

While cryptocurrencies reduce the friction of sending money across borders, “knowledge as a currency” will allow anyone across the world to create a dynamic, immutable, and digital proof of their skills and learning.

This system will greatly increase the amount of people that are able to join the courses, communities, and companies that unlock opportunity and drive innovation. You won’t need a diploma from 8 schools to participate in this framework… or a diploma at all.

Before looking at the future of exchange, it’s worth bringing up a story from the past.

Abraham Lincoln, perhaps the greatest lawyer in American history, had no formal education. “Sixteen” was self-taught and he passed an examination to practice law in the Illinois Supreme Court by reading borrowed books from a local law firm.

Just because Honest Abe didn’t go to a fancy law school did not mean that he lacked outstanding legal skills or that he wasn’t capable of becoming a highly effective lawyer.

Unfortunately, today, the college admissions officer remains the surrogate hiring director for many companies around the world. The college you went to and the degree you received is the proxy for your talents, instead of what you know, what you can do, and how effectively you can do it. Effectively, the admissions director at Harvard is the hiring director at Google.

To us, that makes no sense, as your future shouldn’t be determined by how well you select your parents. In today’s Global Silicon Valley, what companies care about is if you have the skills to be effective (Can you code or not? Are you adaptive?), not if you graduated from some prestigious school.

The old ticket to ride was a degree. The new ticket to ride is going to be a Personal Knowledge Portfolio that incorporates content, courses, and experiences, which are curated over time. The fundamental skills of critical thinking, entrepreneurship, quantitative reasoning, and communication are the foundation of an effective Knowledge Portfolio.

Degrees aren’t going away, but other paths to credentials and skilling will emerge as viable alternatives to a traditional degree — what Chip Paucek at 2U calls “replacement products.”

Badges and certificates for verifiable skills will play an increasing role in a society that shifts its emphasis from the degree you were granted to the knowledge you possess. While traditional education continues to play a role, it’s about knowledge, not college. What you know, not where you go. We call this trend “Knowledge As A Currency,” and we think that it will lead to the future of how we acquire, store, and share our knowledge.

In a recent conversation with Lex Sokolin, Head Economist at ConsenSys, we discussed how a web3 wallet will not just hold digital assets, but will also hold your credentials, schools, diplomas — a “Personal Knowledge Portfolio” on blockchain rails.

A job posting today might ask for someone’s Twitter, LinkedIn, and resume. While that may seem ok, it’s fraught with fraud. LinkedIn removed more than 15 million fake accounts in the first six months of 2021, while Twitter has millions of fake accounts no matter who you ask.

In the future, candidates will only need to submit their Personal Knowledge Portfolio, which holds an immutable, seamless, and secure record of skills and capabilities. Instead of submitting a static resume, people will have a wallet that dynamically updates as they learn (and earn) during their career.

Microsoft has been working on decentralized identity (DID) solutions for the past 18 months. The scenario below illustrates how this type of decentralized identity will work in practice:

Looking forward, Personal Knowledge Portfolios will empower high-quality, lower cost university alternatives and unlock a more transparent, liquid talent pool to the benefit of all stakeholders.

How will this shift benefit all stakeholders? Let’s take transfer students as an example. Here are three ways that this system creates “wins” for each stakeholder: taxpayers, students, and universities.

First, students who transfer lose 43% of the credits they’ve already earned. Losing credits isn’t just inconvenient: it’s costly. In Texas, students who transfer end up with 23 excess credits on average, costing taxpayers $57 million a year and students $58 million a year. A wallet-based system will reduce these costs by allowing students to have a dynamic and digital representation of their knowledge portfolio.

Second, a wallet-based system will allow students to develop their own knowledge portfolio of educational experiences. It will include attendance and participation in classes, workshops, and conferences — not just university credits. This will create a more active marketplace for students to gain learning and employment opportunities.

Coursera and Outlier are already demonstrating that this model can reduce friction and drive down cost at scale:

Third, shifting to a wallet-based system will drive down the cost of marketing and student acquisition for education providers. Today, advertising and email are the primary ways that universities engage and acquire talent… both of which are often inefficient and expensive:

While an email address allows universities to communicate with students, a wallet-based Knowledge Portfolio will allow universities to view a student’s credentials, skills, and interests in a frictionless, seamless way.

This will improve the diversity and quality of students that a university can attract, while also improving their LTV/CAC ratio.

The future of learning is about continuously building your knowledge portfolio from a variety of education experiences and providers. A student’s knowledge portfolio will look more like a Spotify playlist than a static transcript:

The “stars of tomorrow” will be frictionless protocols and knowledge portfolios, not boring platforms and static programs. Until then, we’ll be looking for companies that are building the future of lifelong learning… because the times are a changin’.

Here are five companies to watch bringing Web3 systems to the future of learning:

Microsoft — Microsoft has been working on decentralized identity (DID) solutions for the past 18 months. Potential use cases include DID-signed diplomas issued by universities.

Ed3 DAO: Ed3 DAO is the first DAO for educators, by educators, committed to onboarding 1 million educators into the world of web3.

Learning Machine: Learning Machine (acq. Hyland) is a blockchain credentialing startup that grew out of the MIT Labs. Learning Machine works in the government, healthcare, and education verticals.

Fluree: Fluree provides an extensive set of solutions for secure, connected, and trusted data ecosystems. Fluree has partnered with ASU, US Air Force, and Cardano.

EduDAO: EduDAO is a decentralized autonomous organization (DAO) connecting disparate university ecosystems to enhance collaboration and data exchange and foster a new generation of blockchain and Web3 innovators.

Incred — InCred transforms real world professional achievements into verified credentials

MintKudos — MintKudos turns your individual and team off-chain contributions into on-chain, peer-verified, soulbound tokens

POAPs — POAP or “Proof of Attendance Protocol” is a new way of keeping a reliable record of life experiences. Each time they take part in an event, POAP collectors get a unique badge that is supported by a cryptographic record.

RabbitHole — RabbitHole allows users to learn and earn crypto by using the best web3 applications with an on-chain resume verifying tasks, skills, and credentials that prove your knowledge

Galxe — Galxe is a multi-chain credential infrastructure that empowers brands to build better communities and products in Web3

*Disclosure: GSV owns shares in Coursera and Outlier

Market Performance

Fighting the Fed is one of the fastest routes to financial despair which last week once again showed. The Fed, as expected raised rates 75 basis points. What spooked investors was the commentary that we were long way from home in terms of slowing down rate hikes.

For the week, the Dow decreased 1.4%, the S&P 500 fell 3.4% and NASDAQ was down a whopping 5.7%. Amazon became the third member of the trillion dollar stock club to lose its membership. Amazingly, now 1 Apple is worth a combined Amazon, Meta and Alphabet.

Additionally, former darlings Atlassian and Twilio got clocked last week, (down $77.09 and $32.86), respectively. Draft Kings was also down more than 30% despite growing revenues over 100% and beating Wall Street estimates. The curse put on growth companies right now is the hatred of profitless prosperity….EBITDA is being valued more than growth.

This week, all eyes will be on Tuesday’s elections. From this seat, it looks like the Red Sea with very little change of parting it.

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed this past week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Total Equity Funds went from (2.9) to (9.9) from 10/19 to 10/26. Investors seem confident that this is the last time they’ll see a 0.75 rate hike from the Fed… we’ll see.

#2: IPO Market

There was no “October surprise” for the IPO market. There are still no significant IPOs scheduled in the coming weeks… we’re not seeing any “stars of tomorrow” going public today (or anytime soon).

#3: Interest Rates

The Fed delivered another 75-basis-point rate hike at its meeting this week. Chair Powell said that the Fed “may move to higher levels than we thought” on raising rates, squashing any hopes of a Fed pivot.

#4: Inflation

The Personal Consumption Expenditures Index climbed by 0.3% from August to September, remaining at 6.2% for the year. However, consumer spending increased from 0.6% from August to September. Maybe that’s retail therapy?

Chuckle of the Week

Charts of the Week

The “Global Silicon Valley” thesis continues to unfold: Dallas, DC, and Seattle were the only metro areas that had an increase in startup venture investment.

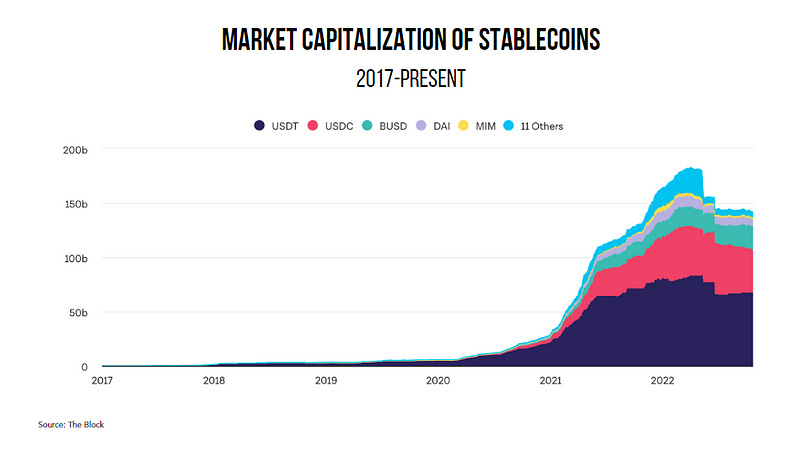

Stablecoins are digital currencies whose values are tied to real-world assets, such as the US dollar.

Less volatile than other cryptocurrencies, they are useful as a medium of exchange and a bridge between fiat currencies and cryptocurrencies.

At the end of October 2022, the total supply of stablecoins was around $140 billion, a 5% increase from the prior year, and about a 520% increase from October 2020.

This rapid ascension is an early signpost of blockchain-based currencies’ traction toward the replacement of fiat currencies.

Video of the Week

Generative AI is capturing all the buzz in Silicon Valley right now, and for good reason. Powerful new applications spanning from text, images, code, audio, and video are appearing on the market

King Gizzard And The Lizard Wizard released a music video for the single “Iron Lung” which is entirely animated using AI

Bands are increasingly using AI imagery for music videos — other examples include GUNSHIP’s “Ghost” and Ängie x Skoj’s “Damned Nice Weekend”

The GSV Big 10

This fall, we launched The GSV Big 10, synthesizing the news to bring you the top 10 stories and insights in learning and skilling. In case you missed it, here are some of this week’s top stories:

#1 PitchBook Universities: Top 100 colleges ranked by startup founders

While Stanford and Cal still lead the pack, the Silicon Valley mindset has gone global. 75% of the top 50 universities are outside New York, Massachusetts, and California. From Austin to Boston; from Shanghai to Mumbai to Dubai, there is something very powerful happening: a Global Silicon Valley is emerging.

#2 How AI will change Education: Part I 🤖

Holy AI, Batman! Humans and AI are like Batman and Robin: our creative minds will always be Batman, while AI excels at being our Robin. AI won’t replace creative thinking but accelerate creative discovery and tasks like grading, assessments, and constructive feedback.

#3 It’s time for colleges to abandon legacy admissions, new research says

Affirmative action is making the headlines, but legacy admissions also deserve a closer look. Harvard legacies are nearly six times more likely to secure admission than non-legacies and remain overwhelmingly white (70% at Harvard). Systemic racism takes different forms…legacies are one example.

… for more insights on the news, subscribe to N2K and The Big 10.

EIEIO: FAST FACTS

Entrepreneurship…

87.5x — valuation multiples of six AI and data startups within The Information’s 50 Most Promising Startups of 2022 (Source)

-40% — loss in a16z’s flagship crypto fund in the first six months of 2022 (Source)

62.1 — the Small Business Index score of Q3’22 — the largest drop since the start of the pandemic (Source)

-53% — decline in North American startup funding in Q3’22 YoY (Source)

-80% — decline in Indian startup funding in Q3’22 YoY (Source)

Innovation…

$4.7 billion — the amount of funding funneled toward European industrial tech startups, on track to raise more than any previous year (Source)

$8.99 — cost per month for to create an AI digital avatar of a dead relative with HereAfter (Source)

999 — number of Epic Edition ‘Lord of the Rings’ NFTs minted by Warner Bros — the first Web3 movie experience from a major studio (Source)

112.5% — Q3 growth in China’s new energy vehicle sector (Source)

44 — amount of times “science and technology” is mentioned in the written CCP Congress report, up from 17 mentions in the 2017 report (Source)

Education…

6 — different lawsuits against Biden’s student loan forgiveness plan (Source)

83% — acceptance rate of recruited athletes with top-scores at Harvard, compared to 16% of non-athletes with similar scores (Source)

1 out of 4 children aged 5 have never had any form of pre-primary education (Source)

52% — percentage of parents who prefer to direct and curate their children’s education rather than rely on local school systems (Source)

40% — percent of college students that primarily learned online in 2022, despite the rebound back to in-person learning (Source)

Impact…

$30,000 — the price of a vehicle under development by Tesla, expanding an addressable market from 5% to 50%. (Source)

30% — higher multiple on invested capital by ethnically diverse founders compared to solely white founding teams (Source)

3 million — U.S. workers who’ve accessed free college through Walmart, Amazon, Target, Macy’s, Citi and Lowe’s educational benefits (Source)

89% — percentage of countries undertaking studies to evaluate the effects of the pandemic on student mental health and well-being (Source)

75% — percentage of impact VC investments allocated into environmental topics (Source)

Opportunity…

300 — number of safety researchers working at large AI labs, compared to under 100 last year. It’s still orders of magnitude fewer than researchers working in the broader field (Source)

2% — amount of 2021 venture capital dollars that went to startups founded solely by women (Source)

-34% — percent that corporate venture capital funding fell in Q3’22 (Source)

40% — percent of community colleges classified as affordable for Pell Grant recipients (Source)

84% — percent of Gen Z-ers who say they want the housing market to crash so they can buy a home (Source)