EIEIO...Healthy, Wealthy, and Wise

By: Michael Moe, CFA, Brent Peus, Owen Ritz, Catherine Merrick

GSV’s weekly insights on the global growth economy. Join 27,000+ readers getting a window to the future by subscribing here:

“Early to bed and early to rise makes a man healthy, wealthy, and wise” - Benjamin Franklin

“Possessions make you rich? I don't have that type of richness. My richness is life, forever” - Bob Marley

“Love and work are to people what water and sunshine are to plants” - Jonathan Haidt

Given all the craziness we’ve experienced in the past few years, it can be tempting to reminisce about the “Good Old Days” when life was simpler.

But before you get carried away, it is worth remembering that the World is exponentially healthier, wealthier and wiser today than it has ever been before. One hundred years ago, more than half of the World’s population lived in poverty. The average male lifespan was half of what it is today. There were less than a million students in higher education at the beginning of the 20th century, compared to well over 200 million today.

Though innovation has been a constant throughout human history, the progress over the past century in particular has been unprecedented. It has unleashed a never before seen level of human flourishing.

Healthy, Wealthy, and Wise: We do not view these pillars in individual siloes, but as interconnected components that drive the overarching objective to ignite Human Flourishing.

Healthy

To see the future, study young people – their interests and habits are what lead us to the specific subcategories that we are most excited about. Millennials and Gen Z are all in on wellness. They drink less, exercise more, and take their vitamins. They are buying the idea of the “quantified self” and using wearable technology (i.e., Whoop, Oura, Q Collar) to gather ongoing data streams that allow them to better understand their bodies.

Rather than relying on reactive treatment to illnesses and injuries, they want to prevent ailments from occurring in the first place and are embracing natural supplements for gut health, skin quality, and overall immunity. They are willing to pay a premium for better nutritional food options (see: Sweetgreen, CAVA, Mendocino Farms), and they prioritize injury prevention when it comes to their athletic training regimens.

This holistic approach that more and more people are taking to manage and optimize their health comes down to a desire for one thing: longevity. They want to extend their lifespan, sure, but they really want to increase their healthspan.

As we talked about two months ago in EIEIO…Forever Young, many of the wealthiest, most educated people on Earth are doing everything in their power to get more of the one thing they cannot buy - time. They are spending incredible amounts of money to receive and develop the most cutting edge treatments, experiences, and routines in order to turn back the clock.

As with all technology-driven trends, all elements of the longevity space will get cheaper, faster and better with time. What is considered avant-garde and reserved for the 1% today will be mainstream and accessible to the masses tomorrow.

While it is incredible that $2,500 can buy you a full-body MRI screening for 500 cancers and diseases today, we will undoubtedly gasp at that price down the road when the same scan is as easy and accessible as stepping onto your bathroom scale in the morning.

If you’re reading these indicators like we are, you likely agree that our “Healthy” genre is poised to explode, with the obsession over longevity leading the way. In 2019, our friend and Longevity Pioneer Jim Mellon said, “There are a maximum of 10 funds focused on Longevity [today]. There’ll be 50-70 in the next few years and in 10 years’ time there’ll be thousands.”

We agree – from consumers, to entrepreneurs, to investors, everyone is going to want to get in on the action.

Wealthy

Our definition of this pillar is slightly unconventional - when we say wealthy we mean “richness of life.”

Maslow was right…people first need to achieve their basic needs before they can aspire to find meaning and purpose to their life. Ironically, as his bottom two pillars (physiological needs and safety needs) have become more achievable than ever, the top three pillars have never been more elusive. There is a massive opportunity for leaders to build solutions geared toward helping more people achieve a sense of love and belonging, esteem, and self-actualization.

In lockstep with our overarching goal of finding and supporting businesses that ignite human flourishing, businesses and subcategories that fall within wealthy are those that improve community, spirituality, and mental wellbeing.

Community creates immunity from loneliness, depression, and despair. As humans, we have an innate need to believe in something and to be a part of things larger than ourselves. There is a massive need to reverse the impacts of anomie, which we talked about in an edition of EIEIO back in April:

Much of society has fallen victim to anomie, a term coined by French philosopher Emile Durkheim in the 19th century that describes a condition of normlessness, lack of moral guidance or shared purpose. This condition gives way to derangement and insatiable will, or as Durkeim calls it, “the malady of the infinite.”

Individuals who have been unmoored from their institutional shackles, free to pursue whatever they want, as much as they want, however they want, become restless, aimless, frustrated and sad.

Driven by significant demand from an atomized and disillusioned population, Mental Health has exploded as a start up category in recent years. There has been an emergence of incredible companies that help people with meditation, mindfulness, habit forming, and prayer.

According to Pew Research, roughly one-in-ten U.S. adults say they use an app or website every day to help them or remind them to read scripture (9%), pray (8%) or be grateful (8%). And 5% say the same about apps or websites that help (or remind) them to meditate.

Combined, the Calm and Headspace apps have been downloaded over 200 million times.

We see many solution categories to the modern ills of society. America’s massive loneliness problem has been designated by the surgeon general as a public health crisis. To combat this, it takes revitalized communities, improved social institutions, and revamped “extracurricular” activities that last well beyond school years. We know that fatherless households lead to a litany of negative second order effects, and we see increased mentorship and coaching as the most sustainable solutions. Depression often comes from a feeling of uselessness, and we believe that mission-driven, purposeful employment and work environments are strong ways to alleviate it.

Strong social fabric is what armors individuals against many of the afflictions of modern life; it anchors us in meaning, provides us with purpose, and allows people to pursue true fulfillment. The businesses and subcategories in our "Wealthy" pillar are those that enrich people's lives in these ways, providing the moral ballast, social connections, and sense of contribution that constitute true wealth. We will continue to hunt for and spotlight the innovators elevating human flourishing beyond the material.

Wise

This pillar focuses on acquiring knowledge and on lifelong learning. Incredible educational resources are now affordable, if not free, and delivered in seamless ways (see Coursera, Learneo, Photomath, Duolingo, to name a few). We believe "invisible learning" will increasingly be built into enjoyable activities - your favorite mediums can and will become around-the-clock classrooms. Like listening to podcasts? Binging YouTube? Gaming? Live sessions? One-on-one tutoring? AR/VR immersion? The endless possibilities lie at your fingertips 24/7.

The astonishing YouTube statistics of Physics Wallah

In a recent interview with

, Marc Andreessen argued that AirPods have been the single biggest technical leap in his life that really mattered. Why? Because they have removed friction that used to impede his learning. “They're the unlock for me for audio books, podcasts and interviews and all these things. I'm doing audio content probably two to three hours a day. And it's, you know, getting up in the morning, going to bed at night, all the drive time” he said.The businesses and subcategories in our "Wise" arena empower people to reach new heights through accessible, frictionless education. We're excited by innovators making learning addictive and omnipresent. Education plays a pivotal role in every single one of the United Nations' 17 Sustainable Development Goals. Equipping people with knowledge unlocks human flourishing.

We see outstanding potential in education technology companies removing barriers to information access. Creative models that incentivize learning through enjoyment, like embedding lessons in games, hold tremendous promise. Knowledge is empowering - we're bullish on startups making it unavoidable.

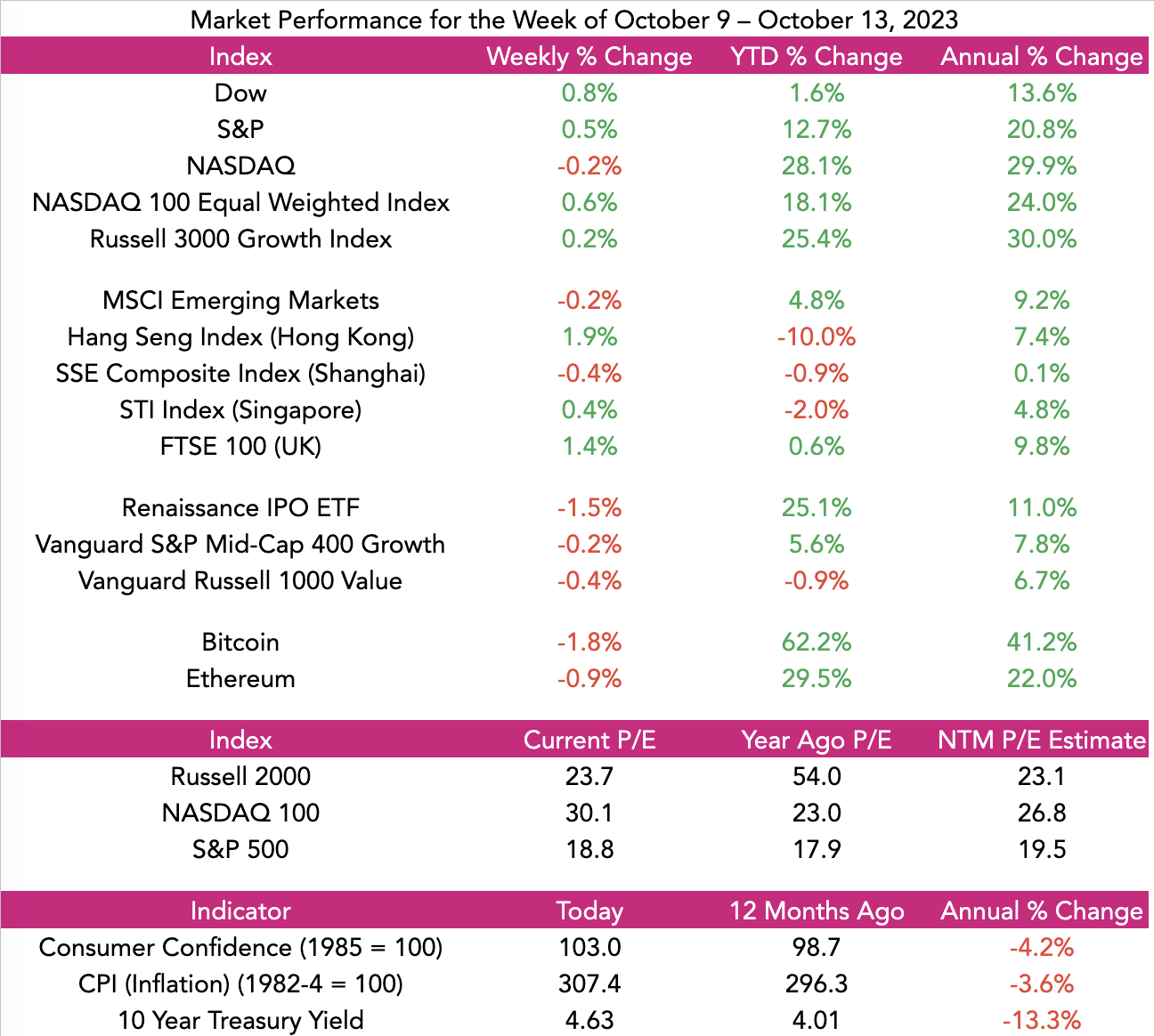

Market Performance

As tensions escalated around the World, investors flocked to the traditional safe havens of gold and Treasuries. Despite the Consumer Price Index rising 3.7% YoY, the 30-year U.S. Bond's yield fell to 4.79% from nearly 5% last week. The 10-year Treasury note's yield fell to 4.62%.

The Dow and S&P rose for the week advancing .8% and .5%, respectively. The NASDAQ fell fractionally.

On the deal front, the much anticipated IPO of legendary shoe maker Birkenstock fell to $41 from its IPO price of $46. The Microsoft $69 billion acquisition of Activision/Blizzard cleared United Kingdom regulatory approval.

China reported flat inflation last month and contracting exports, obviously not a sign of a robust economy. Just in the nick of time, five Senators led by Chuck Schumer visited Beijing last week, which was the first Congressional delegation to the Middle Kingdom since the Pandemic.

We are definitely in frightening times, JP Morgan CEO Jamie Dimon said the scariest in recent memory but stocks refuse to go down. Our thesis is that if stocks won’t go down, they are looking for an excuse to go up. Selectivity of the highest quality growth companies is our focus.

Maggie Moe’s GSV Weekly Rap

Need to Know

READ: Welcome to the State of AI Report 2023

LISTEN: Ray Dalio – Risk, Return, and Asset Allocation

WATCH: Apollo CEO Marc Rowan on UPenn op-ed

READ: Vision Pro Will Be a Hit—Once the Apps Show Up | Deepwater Asset Management

LISTEN: The New Axis of Evil: Condoleezza Rice on War in Israel and a Changed World

WATCH: Inside Tech’s Fight Against Climate Change | Exponentially with Azeem Azhar

READ: On Expectations: Low, Low, Low, Low, Low, Low, Low, Low

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

Source: Renaissance Capital

#3: Interest Rates

Source: Atlanta Fed

#4: Inflation

Source: Charlie Biello

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 31% – 2023 Series D rounds that have been down rounds (Carta)

Innovation: 97.8% – decrease in OpenSea monthly NFT volume from January 2022 to August 2023

Education: 36% – US adults who are satisfied with K-12 Education (Axios)

Impact: 8% – US adults with no close friends (Pew Research)

Opportunity: 18% – population that is 65 or older, the highest on record since 1920 (Forerunner Ventures)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM