EIEIO...The Global Silicon Valley

By: Michael Moe, CFA, Brent Peus, Owen Ritz, Catherine Merrick, Matthew Yost, Holt Randall

GSV’s weekly insights on the global growth economy. Join 22,000+ readers getting a window to the future by subscribing here:

“Silicon Valley is a mindset, not a location.” – Reid Hoffman

“The secret of change is to focus all your energy, not on fighting the old, but building the new.” – Socrates

“If you want to build a great company, get the hell out of Silicon Valley.” – Bill Gates

In 1849, pioneers from around the world came to California looking for gold, and what once was an empty landscape of natural beauty turned into a densely populated melting pot. A hundred and seventy something years later, the gold is long gone but the land of opportunity continues to BOOM. People still flock to California to chase a dream, but now one that is intermixed with microchips, apps, social networks, and most important: Silicon Valley.

At the heart of the tech revolution still in mid-swing, Silicon Valley is home to the superstars Apple, Alphabet, and Meta; the old-timers Intel and HP; and of course, the thousands of little guys still trying to make it: the startups. But Silicon Valley has quickly become more than a geographic spot on a map; it is a mindset of innovation that has spread across the globe, and that’s what we at GSV stand for.

One hundred years ago, Silicon Valley was filled with apricot and apple orchards with a forty-year-old fledgling university called “The Farm.” Detroit was the innovation capital of the world with the young and ambitious migrating to the Motor City to seek fame and fortune. Automobiles were the disruptive technology, and Henry Ford was the Steve Jobs of his day.

Today, Detroit is a shadow of its former self has come out of bankruptcy, and Silicon Valley has been the Mecca for entrepreneurs from around the world who believe that there is nothing more powerful than a big idea. Stanford University is Startup U, where people flock to pursue their dreams. Over the past fifty years, it’s been breathtaking to see how companies conceived on a napkin at Buck’s and started in garages between San Francisco and San Jose have transformed society and business.

While the sixty miles between San Francisco and San Jose remain the epicenter for innovation (see 2023 guide below), the spirit and entrepreneurial mindset that made Silicon Valley such a magical place have gone viral and global. From Austin to Boston, to Chicago and São Paulo; from Shanghai to Mumbai to Dubai, there is something very powerful happening: a Global Silicon Valley is emerging.

GSV created a formula for determining the top fifty markets in the Global Silicon Valley based on factors such as VC funding, startup activity, educational institutions, business climate, adults with college education, median age, infrastructure, entertainment options, etc.

We then researched each market to highlight key features and asked the local experts to understand what makes their city tick. We provide entrepreneurs need-to-knows on how to be successful in bringing their concept to life. Who are the top angels? Which are the top incubators? What should be in the pitch? What shouldn’t be in the pitch? Where is the power breakfast spot? What is the dress code? And much, much more…

In March 2017, we published the Global Silicon Valley Handbook, a fun (and factual) guide on how to thrive not only in Silicon Valley, but in the emerging Global Silicon Valley.

Since then, the Global Silicon Valley thesis has played out at an even greater scale than we predicted. COVID accelerated the future to the present, with the Global Silicon Valley Megatrend going into overdrive.

Many predicted at the height of COVID that Silicon Valley would never be the same.

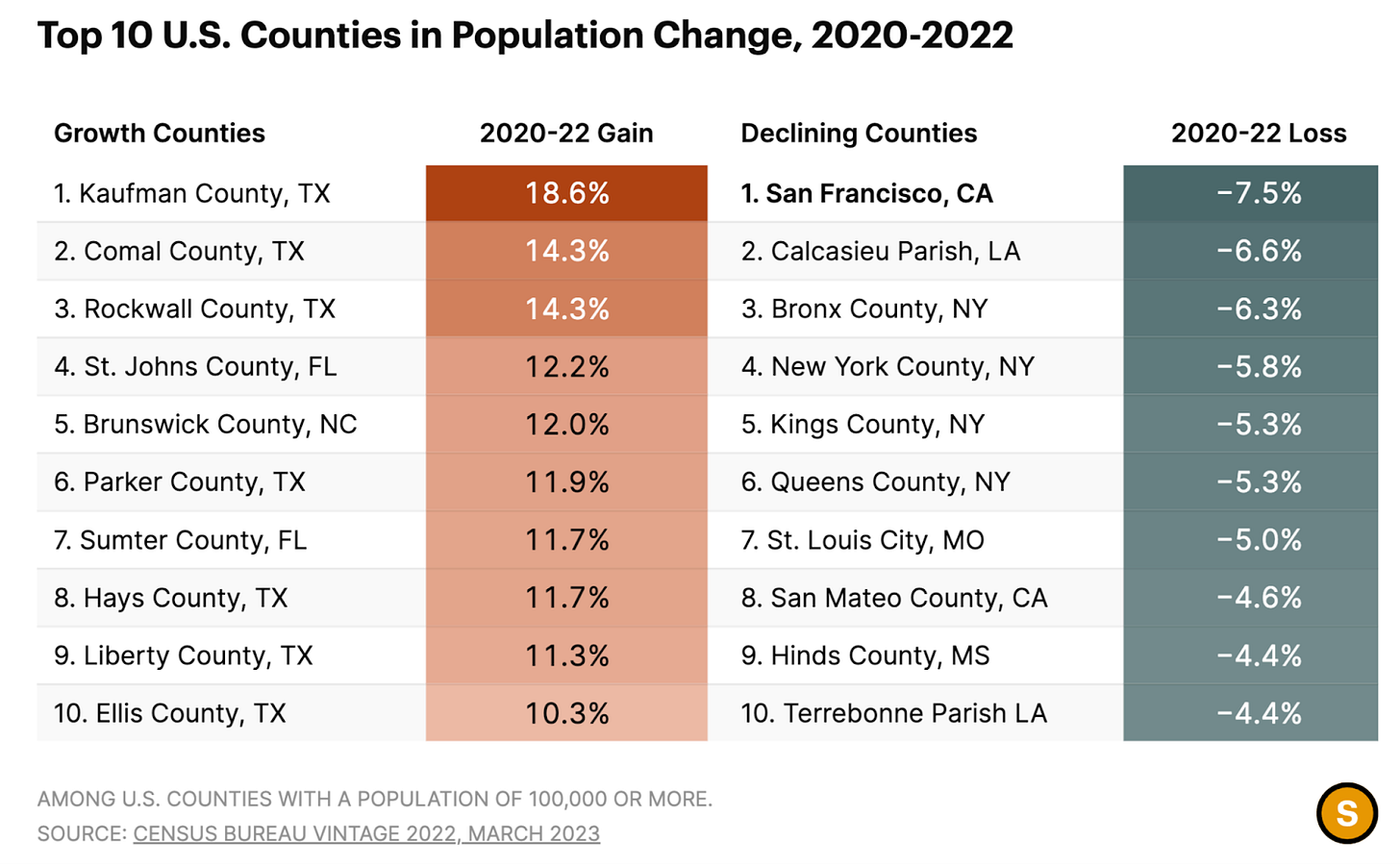

The triple play of remote work, rising crime, and increasing cost of living contributed to the largest net outflow of talent in the country since 2020.

While some of the challenges of the Bay Area led to people prematurely calling it dead, nowhere have the embedded advantages come into the full view as the AI tidal wave that came onto shore last fall. Even with its challenges, San Francisco is home to 20 of the best-funded AI companies – more than the rest of America combined.

Silicon Valley was a fifty-year overnight success. From the time of David Packard and Bill Hewlett’s launch in the garage in 1939 to the Apple IPO, most people viewed San Fransisco as a backwater in business, with very few having any understanding or interest in what was going on in the City by the Bay.

The fact is creating a local ecosystem takes time, and not surprisingly, from a lagging indicator perspective, Silicon Valley remains #1.

The fundamentals are hard to replicate: there’s no place on Earth that is as beautiful as California, and the combination of its world-class research institutions and the Big Tech incumbents continue to attract world-class talent. It’s no wonder that the AI boom is being driven by Silicon Valley.

But the real insight is that there is a double whammy of forces fighting against Silicon Valley’s favor, which doesn’t show up in the immediate numbers.

Headwind #1 for Silicon Valley remaining dominant is that other markets in the world are taking off, accelerated by digital infrastructure that allows you to operate from everywhere. Historically, a rule for venture capital was that if you couldn’t drive to the company in 15 minutes, you wouldn’t fund the company. Startups are a contact sport.

Headwind #2 is that San Francisco has tried to commit suicide, including out-of-control crime, cost, complacency, chaos, and some would argue communism. A wealthy friend recently told me that the state might as well tax you 100% because anyone who’s still living here obviously doesn’t care about taxes.

There are people that make things happen. There are people that watch things happen. And there are some people that say “What happened?” We’re looking to be a guide to provide information not only on what’s taken place, but insight on where the future is going to be created, and where the stars of tomorrow will be born.

In our updated 2023 report, we provide detailed breakdowns of the current Global Silicon Valley landscape. We cover cities on the rise (Lagos), on the fall (Toronto), and surprise arrivals (Bogota).

The Top 50 Cities are….

Silicon Valley Bay Area (–)

New York (↗️)

London (↗️)

Los Angeles + San Diego (–)

Boston + Cambridge (–)

Bangalore (↗️↗️)

Tel Aviv (↗️)

Austin (↗️↗️)

Abu Dhabi + Dubai (↗️↗️)

Paris (–)

Berlin (–)

Miami (↗️↗️)

Singapore (↗️)

Washington DC + Baltimore (↗️)

Sao Paulo (↗️)

Dallas-Fort Worth (↗️↗️)

New Delhi (↗️↗️)

Stockholm (↗️)

Mumbai (↗️)

Amsterdam (–)

Beijing (↘️↘️)

Denver + Boulder (↗️)

Salt Lake City (↗️↗️)

Chicago (↘️↘️)

Toronto-Waterloo (↘️↘️)

Seoul (–)

Atlanta (–)

Tokyo (↗️)

Seattle (↘️↘️)

Sydney (↗️)

Shanghai (↘️↘️)

Dublin (↘️)

Shenzhen (↗️) + Hong Kong (↘️)

Jakarta (↗️)

Munich (↗️)

Helsinki (↗️)

Nashville (↗️↗️)

Vancouver (↘️)

Barcelona (–)

Copenhagen (↗️)

Philadelphia (↘️)

Phoenix (↗️)

Mexico City (↗️)

Research Triangle + Charlotte (↗️)

Lagos (↗️)

Melbourne (↗️)

Pittsburgh (↗️)

Kuala Lumpur (–)

Bogota (↗️)

Nairobi (↗️↗️)

Check out the full 2023 Global Silicon Valley Handbook, with special thanks to our Summer Interns Matthew Yost and Holt Randall:

Market Performance

Stocks continued to act favorably to the likelihood that the Fed rate hikes were nearing an end, inflation seems to be getting under control, and the Economy remains resilient.

For the week, the NASDAQ remained out in front advancing 2%, the S & P was up 1% and Dow inched up .6%. Particularly encouraging is that while the S & P 500 is up 18% YTD, the participation in the advancement has broadened. Moreover, while valuations on a couple handful of the darlings seems a bit extended, overall, stock prices seem OK.

GDP growth came in at 2.4%, above estimates of 1.8%, and Q1’s 2.0%. Another data point that is bullish was Google’s strong numbers and articulation that online advertising was picking up. On the slightly confusing side, Microsoft reported its worse yearly revenue growth number in six years and its AI business was below expectations.

We remain constructive on our outlook for the Market and especially, high quality growth stocks. The trend is your friend complimented by improving macro fundamentals.

Need to Know

READ: 10 Charts That Capture How the World Is Changing

LISTEN: Chris Paik - Venture Investing Frameworks

WATCH: Disrupt or Be Disrupted: Venturing into Tech | Milken Institute

READ: Giverny Capital Asset Management Q2 2023 Quarterly Letter

LISTEN: Founders: Christopher Nolan

WATCH: MongoDB CEO Dev Ittycheria on great leadership, building winning teams, and more

GSV’s Four I’s of Investor Sentiment

GSV tracks four primary indicators of investor sentiment: inflows and outflows of mutual funds and ETFs, IPO activity, interest rates, and inflation. Here’s how these four signals performed last week:

#1: Inflows and Outflows for Mutual Funds & ETFs

Source: Yardeni

#2: IPO Market

The major hurdles to an IPO revamp have been lifted: stocks from Airbnb to Walmart are hitting new 52 weeks, the VIX has been under 20 for the past few months, inflation has eased, and individual investors are as bullish as ever. Arm, Klaviyo, Turo, and Birkenstock are all rumored to be considering an upcoming offering.

Source: Renaissance Capital

#3: Interest Rates

The Fed raised rates another quarter basis point as expected. The Fed provided little guidance about when it might hike rates again. The market is currently pricing in a 4% Fed Funds Rate by January 2025. As ICONIQ’s Doug Pepper puts it, survive to thrive in 2025…

Source: Charlie Biello

#4: Inflation

The IMF published their World Economic Outlook this week, increasing their forecast for global growth this year to 3% from 2.8% in April. Global inflation is projected to decline from 8.7% last year to 6.8% this year, a 0.2% downward revision, and 5.2% in 2024.

Charts of the Week

Chuckles of the Week

EIEIO…Fast Facts

Entrepreneurship: 2.4 – number of significant software companies ($10B+ US public / private software companies) founded per year from 2000 to 2017 (Zach DeWitt)

Innovation: 73% – fewer collisions with a meaningful risk of injury for a Cruise taxi than the typical human ride-hail driver in San Francisco in their first million driverless miles (MIT Technology Review)

Education: $587,400 – average lifetime earnings increase for a US college-educated man vs. a high-school educated man (The Economist)

Impact: 91% – Hinge singles who would prefer to date someone who goes to therapy (Hinge)

Opportunity: 42% – Americans who believe they are on their way to achieving the American Dream (The Jerusalem Post)

Connecting the Dots & EIEIO…

Old MacDonald had a farm, EIEIO. New MacDonald has a Startup…. EIEIO: Entrepreneurship, Innovation, Education, Impact and Opportunity. Accordingly, we focus on these key areas of the future.

One of the core goals of GSV is to connect the dots around EIEIO and provide perspective on where things are going and why. If you like this, please forward to your friends. Onward!

Make Your Dash Count!

-MM